DataGardener’s Business Insights Report reveals key trends shaping the UK business landscape. According to February UK Business Insights, we’ve seen a surge in new business formations, bringing fresh optimism, yet existing companies continue to face challenges.

With just 28 days, February proves that even a short month can drive significant shifts in the market! Whether you’re a business owner, investor, or industry professional, our report gives you the insights you need to stay ahead.

Explore the full report to discover the latest trends shaping businesses in the UK!

Business Overview

- New Businesses Incorporated: February has seen a strong wave of entrepreneurial activity, with more than 61K new businesses registered across the UK. This surge demonstrates growing confidence and innovation as businesses are created to meet new market demands.

- County Court Judgments (CCJs) Filed: Despite the positive new business growth, the first month of 2025 also saw over 10K County Court Judgments (CCJs) filed. This reflects some businesses’ ongoing financial challenges, highlighting the importance of economic resilience and sound business management.

- Charges Registered: February also witnessed 14K+ charges being registered against businesses, pointing to the continued pressure businesses may face with legal or financial obligations.

These figures highlight a dynamic and evolving business environment, offering a valuable snapshot of the UK economy’s current state. Stay informed and explore the full report to learn more.

Business Start-ups & Closures

Business Incorporated

February 2025 saw an impressive surge in entrepreneurial activity, with over 61K new businesses being registered. This marks a notable decline from the 68K+ registrations in January 2025. This uptick in start-ups suggests a wave of optimism and new ventures as businesses look to capitalise on the opportunities the new year brings.

Business Dissolutions

Company dissolutions saw a notable rise in February 2025, with over 67K businesses shutting down, compared to 62K+ in January 2025. This increase highlights ongoing challenges in business stability despite the rise in new registrations. Factors like market uncertainties and shifting economic conditions may contribute to this trend.

Private Sector Business Data Overview

January 2025 vs. December 2024

In February 2025, 60K+ new private sector companies were incorporated, reflecting an 11.66% decrease compared to January 2025, which saw 67K+ new incorporations.

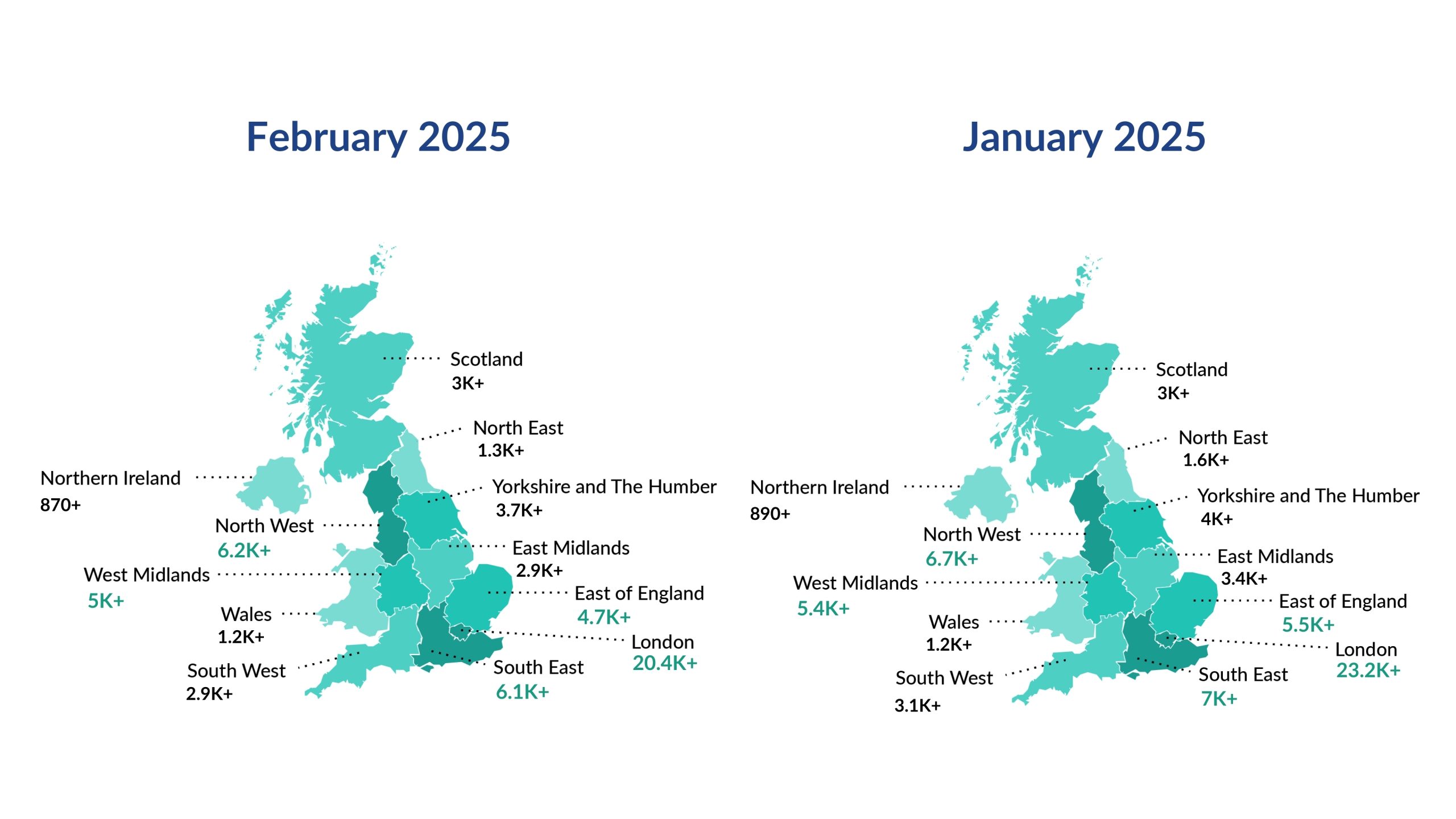

Regional Distribution of Private Sector Companies Incorporated

London Remains on Top, But Other Regions Are Gaining Ground

London continues to lead the charge, making up 33.51% of new businesses. However, its share has dipped slightly from 34.15%, highlighting the rise of business activity in other regions across the UK.

Regional Powerhouses on the Rise

- North West: Down by 8% (6,185 vs. 6,722)

- South East: Saw a 14% decrease (6,145 vs. 7,009)

- The East of England and Yorkshire also saw notable boosts, underscoring the growing business opportunities beyond London.

Steady Growth in Key Regions

Scotland, Northern Ireland, and Wales showed only slight changes, indicating that business activity remains stable and consistent.

What This Means for the UK Economy

This surge in new businesses reflects entrepreneurial confidence, potential government support, and a broader shift towards decentralised growth across the UK. The future looks bright for companies outside London as more regions tap into new opportunities.

Top SIC Industry Classifications of Newly Incorporated in Private Sector

February 2025 Sector Highlights: Growth and Shifts Across Industries

In February, the Wholesale & Retail Trade sector remained the largest, making up 18.92% of new businesses, though slightly down from January. Real Estate and Professional Services also saw slight declines, while Construction surged, growing from 8 to 10%.

Accommodation & Food Services and Administrative Services held steady, while Information & Communication dropped. Health & Social Work and Financial Services also declined.

Smaller sectors like Manufacturing and Education remained stable, while industries like Agriculture and Mining showed limited growth.

In summary, construction and accommodation are rising, while traditional sectors like retail and financial services are facing modest changes. The UK’s business landscape is evolving, with exciting opportunities emerging in newer industries.

Comparative Data

Companies Incorporated February 2025 vs January 2025

In February 2025, 61K+ new companies were incorporated, marking a decrease of 11.46% compared to January 2025, when 68K+ companies were incorporated.

Regional Distribution of Companies Incorporated February 2025 Vs January 2025

The regional distribution of companies across the UK presents a diverse economic landscape. London stands out as the commercial heart, hosting 39K+ companies, 34.68% of the total. This is a significant lead over other regions, reflecting London’s status as a business hub.

The South East also plays a significant role, with 11K+ companies making up 10.16% of the total, indicating a substantial economic presence.

On the lower end, Wales and Northern Ireland have the most minor numbers, with 2K+ (1.83%) and 1.6K+ (1.41%) companies, pointing to a more modest business density in these areas.

Risk Assessment of Companies Incorporated in January 2025 to February 2025

The assessment of company risk profiles reveals a varied landscape within the region’s business sector.

In the business risk landscape, most companies are positioned in the moderate-risk category, with 98.69% demonstrating a balanced approach to risk management. This significant proportion indicates a preference for stability and calculated risk-taking in business operations.

Very high-risk entities comprise 1.08%, while high-risk companies constitute 0.22%. These figures represent businesses that may engage in high-stakes ventures, necessitating sophisticated risk mitigation strategies.

On the safer end of the spectrum, very low-risk companies account for a mere 0.02%, reflecting a cautious stance in the market.

The distribution of risk underscores the importance of tailored risk management practices for effectively navigating the complexities of the business world.

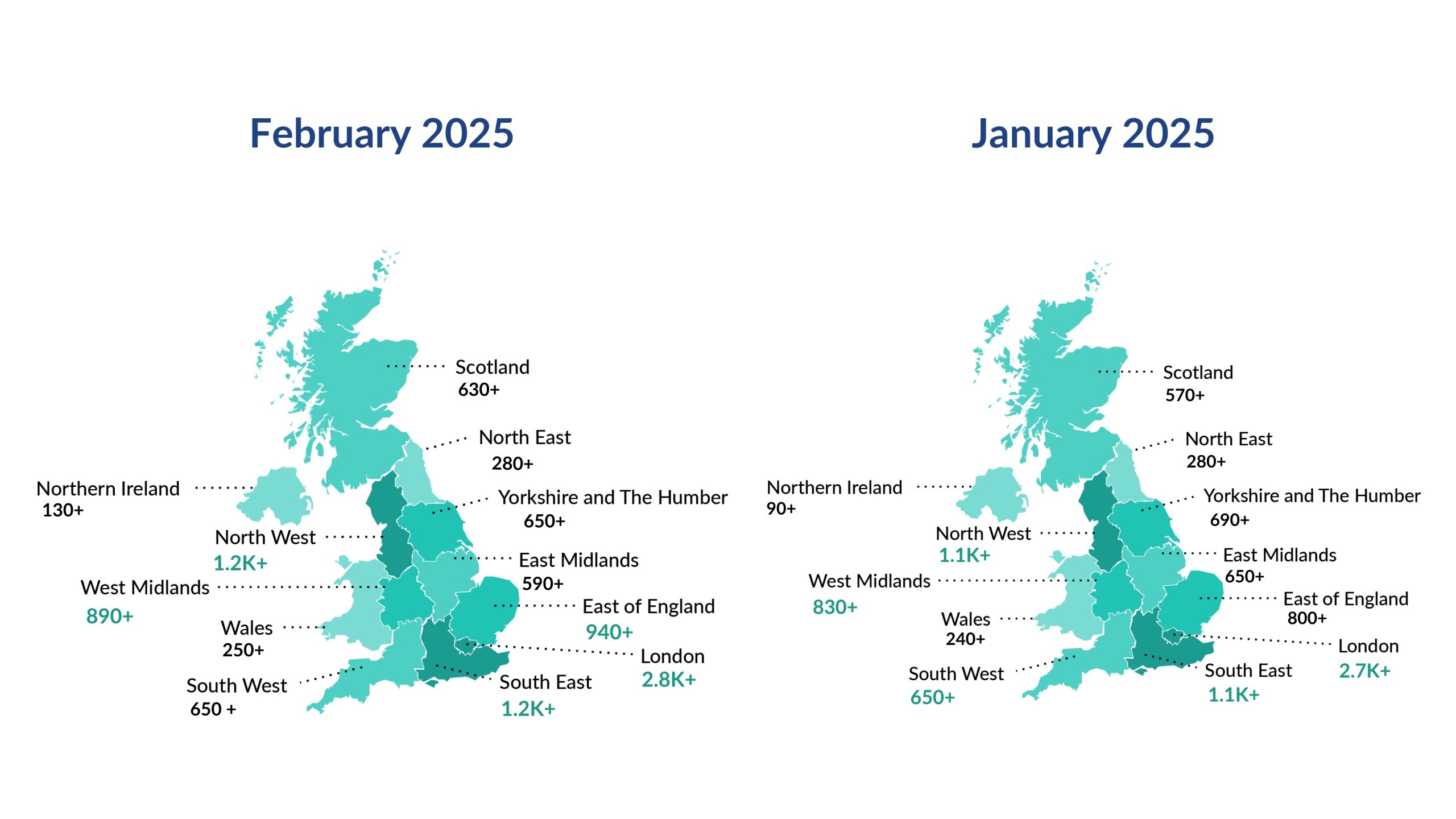

Charges Registered February 2025 vs January 2025

In January and February 2025, over 10K outstanding charges were registered each month; there was no significant difference between the two months.

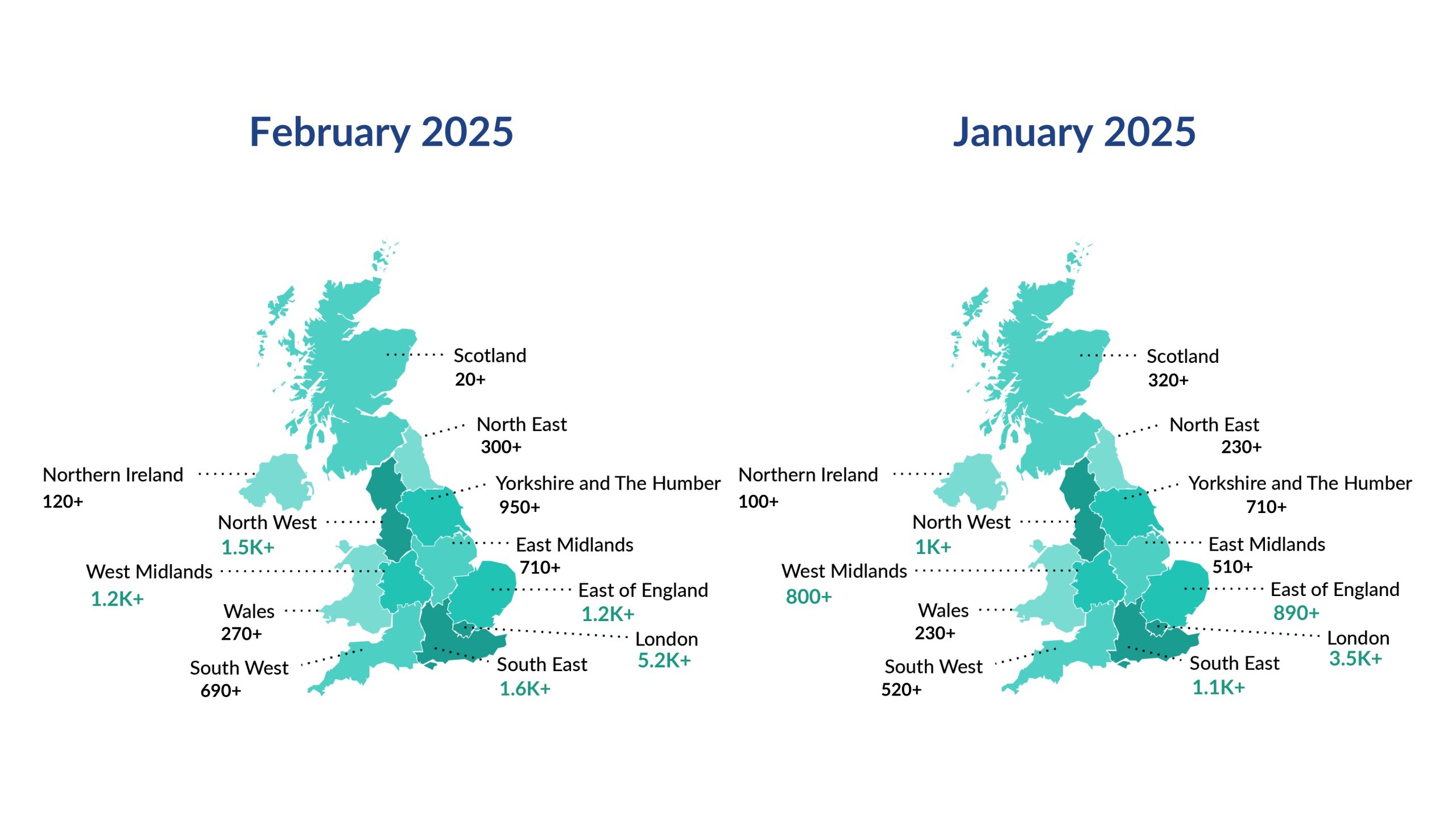

County Court Judgements (CCJs) Filed in February 2025 Vs January 2025

In February 2025, 14K+ CCJs were filed, which is greater than the 10K+ CCJs filed in January 2025.

New Companies Registered in February 2025

Industrial Distribution

The analysis of the Standard Industrial Classification reveals a diverse array of industries, each contributing to the overall landscape of the company registered.

The Wholesale/Retail Trade sector leads with 18.67% of registered companies, followed by Real Estate Activities and Professional, Scientific, and Technical Activities, both of which account for over 9-10% of registered companies.

Construction and Information/Communication also have a notable share, each around 7-8%.

This data suggests that these sectors are more likely to register companies due to their operational scale and regulations, providing critical insights for risk management and market opportunity identification.

Female Founders

In February 2025, over 10K new companies were registered as owned by females, marking a significant rise from the 8K+ companies registered in January 2025.

Female-Owned Businesses: Industry & Regional Insights – February 2025

Top 3 Industries for Female-Owned Businesses

February 2025 reveals a strong presence of female entrepreneurs across various sectors, with notable leadership in the following industries:

- Wholesale and Retail Trade: With 1.9K+ businesses, this sector leads female entrepreneurship, accounting for 19.33% of all female-owned companies. The industry remains a key area for women in business, offering opportunities in traditional retail and emerging e-commerce markets.

- Professional, Scientific and Technical Activities: Home to 1.2K+ businesses (12.69%), this industry continues to grow as women break into traditionally male-dominated fields such as engineering, technology, and consultancy.

- Real Estate Activities: With 1K+ businesses (9.86%), real estate stands out as another significant area for female entrepreneurs, especially with the rise of women in property management, development, and investment.

Top 3 Regions for Female-Owned Businesses

The regional distribution of female-owned businesses shows a clear trend towards urban hubs and economically diverse areas:

- London: With 3K+ businesses (32.28%), London remains the epicentre of female entrepreneurship. The city offers vast opportunities in finance, tech, and creative industries, making it a hotspot for women looking to start or scale their businesses.

- South East: The South East follows with 1K+ businesses (10.55%), reflecting its growing economic importance and the increasing number of women-led enterprises in retail, healthcare, and professional services.

- North West: With 1K+ businesses (10.35%), the North West continues to rise as a key region for female entrepreneurs, supported by a strong local economy and a thriving network for women in business.

Note: Data sourced from DataGardener’s February 2025 UK Business Insights report. For more detailed analysis and insights, contact us.