Many businesses, especially small and medium-sized enterprises (SMEs), often face the challenge of maintaining a healthy cash flow. Managing the billing and collection process can be time-consuming and administratively demanding for businesses. Chasing down late payments, keeping track of invoices, and reconciling accounts can divert valuable time and resources from core business activities, creating a significant administrative burden.

Invoice finance can solve this problem, which delegates the responsibility for invoice collection and management to a specialised financing company by effectively reducing the administrative burden on businesses. By streamlining the procedure, this solution helps companies to focus on their main activities.

No time to read? Watch our tutorial on Invoice Finance 👇

About Invoice Finance

Any company or business can quickly solve financial problems using this invoice finance. It includes using unpaid balances as security to get a loan or financial help. In other words, this finance empowers a company to use its invoices as collateral to get quick financial support from any financial institution. It is a funding choice for companies or businesses that generate a minimum of £30,000 in annual revenue and get paid by invoice within 14 days or more.

Invoice financing provides any business with immediate access to cash, which they can use for various purposes, such as covering operational expenses, investing in growth, or managing their working capital.

Types of Invoice Finance

There are three different types of invoice finance available in the UK:

1- Invoice Factoring- This type of finance is beneficial for businesses that face cash flow challenges due to slow-paying customers or seasonal fluctuations in revenue. It allows them to access immediate cash to cover operating expenses, invest in growth, or take advantage of business opportunities.

2- Invoice Discounting- Businesses can benefit from invoice discounting in several ways, including increased cash flow, flexibility in choosing which invoices to discount, and control over client interactions and collections.

3- Selective Invoice Finance- For companies that wish to control their accounts receivable and decide which invoices to finance, selective invoice financing can be an appealing option. Without being forced to finance all outstanding invoices, it gives you the freedom to address particular cash flow issues.

How Invoice Finance Works

- Company issue invoices: When a company offers its customers goods or services, it issues invoices with payment terms that usually last 30 to 90 days. These unpaid invoices are accounts receivable, which are sums of money the company is owed.

- Application and Approval: The company interested in invoice financing applies to a factoring company or a financial institution for this kind of financing. This factoring company will judge the creditworthiness of the company and the quality of its accounts receivable.

- Agreement and Due Diligence: If accepted, the factor and the company sign a contract detailing every aspect of the invoice financing arrangement. The factor could do due diligence to ensure the accuracy of the bills and the customer’s creditworthiness.

- After due diligence, the factor typically gives the business an immediate cash infusion in exchange for a percentage (typically between 70% and 90%) of the invoice’s face value.

- Submission of an invoice: Business activities continue as usual, including deliveries of products or services to clients and the issuance of bills. However, outstanding amount is paid to the factor rather than the customer.

- Funding: The loan provider pays the remaining portion of the invoice after receiving the payment, typically within 1-2 days.

Pros and cons of Invoice Finance

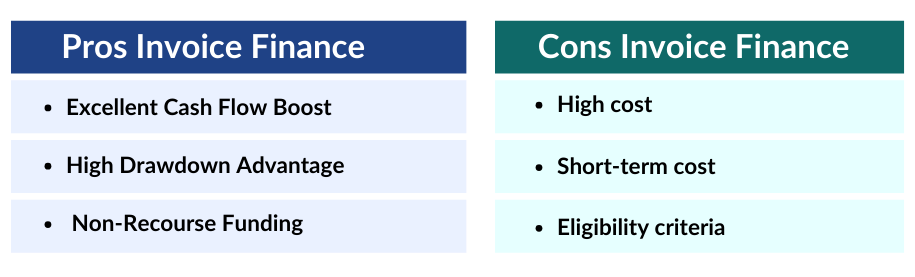

Before opting for invoice financing, it’s essential to be aware of both the advantages and disadvantages associated with this financial solution, as it can be highly beneficial for a business but also comes with certain drawbacks.

Pros of Invoice Finance

- Excellent Cash Flow Boost: This is one of the easiest ways to improve any business’s cash flow, especially for small businesses.

- High Drawdown Advantage: Offers the best and higher drawdown than traditional financial options, such as a bank or a credit card loan. The best thing is this drawdown is directly related to the business’s revenue.

- Non-Recourse Funding: It can secure competitive funding without dependence on personal assets and offer financial support without putting them at risk.

Cons of Invoice Finance

Apart from the pros, there are many cons in Invoice Financing:

- High cost: This is an expensive way to raise the capital of any business.

- Short-term cost: There might be high chances when you must pay for services like discount fees, service fees and interest the company provides.

- Eligibility criteria: Normally, not all businesses are eligible to get invoice finance as all the companies often have specific criteria for the businesses they will be providing finance.

So, for a business considering invoice financing, it’s essential to consider all the cons and weigh them against the advantages of invoice finance.

The cost of Invoice Finance in the UK

Invoice financing companies in the UK make money in two important ways:

- Charge interest

- A credit management fee

- Usually, a facility set-up fee (in many cases)

Profits cover the cost of using their money, while debt costs cover their operating expenses. You’ll pay interest rates typically between 1.5% and 3% above the Bank of England’s base rate, and you’ll also incur debt charges, typically between 0.25% and 0.5% of your annual business income and savings in the form of loans.

How do you decide which is right for you?

There are two ways you can do this: Either by researching companies yourself – in which case you need to be completely sure of the type of facility you need (Factoring, Invoice Discounting or Selective Invoice Finance) and approach the companies directly or use a Commercial Finance Broker.

Using a Commercial Finance Broker could be a great option since they will have access to multiple funders and remove a lot of the hard work from you.

You can find a broker in your area by using LinkedIn or by looking for a local broker through the NACFB or FIBA.

Conclusion

Numerous businesses often encounter financial challenges, particularly when customers delay payments or face personal difficulties affecting their payments. These businesses need more funds in their banks to obtain loans. Invoice financing can help you deal with these difficulties at this crucial moment. It offers a quick and effective way to get cash by using unpaid bills as security.