Introduction

Welcome to the world of commercial lending, where opportunities and challenges occur in a highly competitive market. Finding commercial lending prospects can be exciting and scary as a financial institution or lender. But fear not! In this blog post, we will explore practical strategies to help you navigate through the noise and stand out from the crowd.

Understanding your target audience is essential to customise your strategy when dealing with different financing choices, such as unsecured and secured. Knowing where to hunt for potential borrowers is essential, whether you want to provide commercial loans for real estate projects or help small company owners with their development goals.

So grab your thinking cap and dive into commercial lending as we uncover growth prospects, analyse market trends, and develop an actionable marketing plan to set you apart from other lenders.

Commercial Lending Market Highlights: – Unsecured Lending and Secured Lending

The commercial lending market offers a range of options for businesses looking to secure financing. Two common types of lending in this market are unsecured and secured:

Unsecured lending

Unsecured lending involves borrowing money without the need for security. This type of loan is typically based on the borrower’s creditworthiness and financial history. It can be an attractive option for small business owners who may not have significant assets to offer as security.

Secured lending

On the other hand, secured lending requires borrowers to provide security, such as real estate or equipment, which serves as security against the loan. In exchange for offering security, borrowers may receive more favourable interest rates and terms.

Both unsecured and secured lending have advantages and disadvantages depending on individual circumstances. For businesses seeking growth prospects, understanding these different types of loans can help them choose the most suitable option that aligns with their financial goals.

By thoroughly researching the commercial lending market, businesses can identify lenders that specialise in their industry or offer specific products and services tailored to their needs.

Financial institutions must evaluate their offerings to stay competitive in this market and continuously adapt accordingly. By keeping track of market trends, staying updated on regulatory changes, and analysing data from sources like DataGardener, lenders can position themselves strategically to gain a larger share of the market.

Strategies for finding prospects for commercial lending

In a competitive market where lenders are vying for the same pool of potential borrowers, it is crucial to employ effective strategies to find prospects for commercial lending. Here are some strategies that can help financial institutions stand out and attract growth prospects:

- Researching the market: Understanding the landscape and trends in the commercial lending market so you can identify growth prospects and tailor your lending options accordingly.

- Finding your target audience: Who are you trying to reach? What are their needs and pain points? You can tailor your marketing efforts accordingly once you know your target.

- Developing a marketing plan: A marketing plan should include a clear understanding of your target audience, the best channels to reach them, and the types of content and messaging that will resonate with them.

- Executing your plan: Executing your plan means putting your marketing plans into action and tracking your results to see what’s working and what’s not.

- Being creative and innovative: The commercial lending market is constantly evolving, so you need to be willing to think outside the box and come up with new and creative ways to reach your target audience.

- Building relationships: Networking with other professionals in the industry can help you get your foot in the door and connect with potential borrowers.

- Staying up-to-date on industry trends: The commercial lending market is constantly changing, so it’s essential to stay up-to-date on the latest trends to offer your clients the best possible service.

How DataGardener Can Help

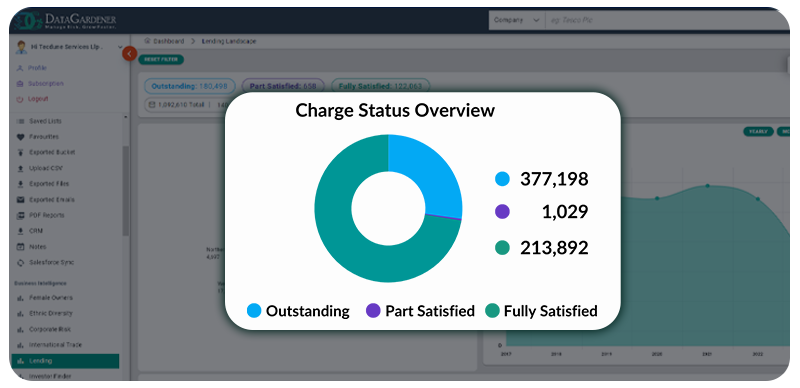

DataGardener’s Lending Intelligence Tool can help businesses overcome these pain points by providing access to a wealth of data on businesses seeking commercial loans, including information on their financial health, industry, location, and other factors. This data can identify potential prospects that are a good fit for a business’s lending criteria.

How to Use DataGardener’s Lending Intelligence Tool to Find Prospects

In addition to providing access to data, DataGardener’s Lending Intelligence Tool also offers several features that can help businesses find prospects more effectively. To use DataGardener’s Lending Intelligence Tool to find prospects, you can follow these steps:

- Define your target market: What industries are you interested in lending to? What size businesses are you targeting? Once you know your target market, you can use DataGardener’s filters to narrow down the search results.

- Advanced search filters: You can use advanced search filters to find businesses matching specific criteria. For example, you can use the AND operator to find businesses that meet multiple criteria.

- Create visualisations: You can use visualisations to understand the data better and identify trends. This can help you identify growing or expanding businesses that may be more likely to need a commercial loan.

- Stay up-to-date on the latest data: DataGardener’s Lending Intelligence Tool is constantly updated with new data. This ensures you have the most accurate information when making lending decisions.

- Monitoring: Helps businesses track the performance of their competitors and other market participants.

Conclusion

DataGardener’s Lending Intelligence Tool is a powerful tool that can help you find prospects for commercial lending more effectively. By following the tips in this article, you can use the tool to improve your chances of success in the competitive commercial lending market.