(Exclusive UK Business Intelligence Report — Powered by DataGardener)

With a high volume of company write-offs now being reported, over the last 60 days, the UK business landscape has experienced significant financial disruptions, particularly in key industries. These aren’t isolated failures. They represent growing economic stress signals across sectors in which you may work, sell to, or invest in.

If you’ve ever asked:

- “Which UK industries are most at risk right now?”

- “Which UK industries are showing signs of financial distress?”

- “What regions are facing the most business closures?”

- “Where are the highest insolvency rates in the UK right now?”

This exclusive insight, powered by DataGardener’s UK business intelligence platform, pinpoints the sectors most impacted, regions most at risk, and the scale of insolvency trends threatening UK commercial stability.

What Are Write-Offs and Why Does It Matter?

In the business context, a write-off typically refers to a company’s failure to meet its financial obligations, often due to insolvency, liquidation, or default. Monitoring industry-level write-offs helps you:

- Avoid high-risk partners or clients

- Strengthen your risk management strategy.

- Identify distressed sectors for investment or acquisition opportunities.

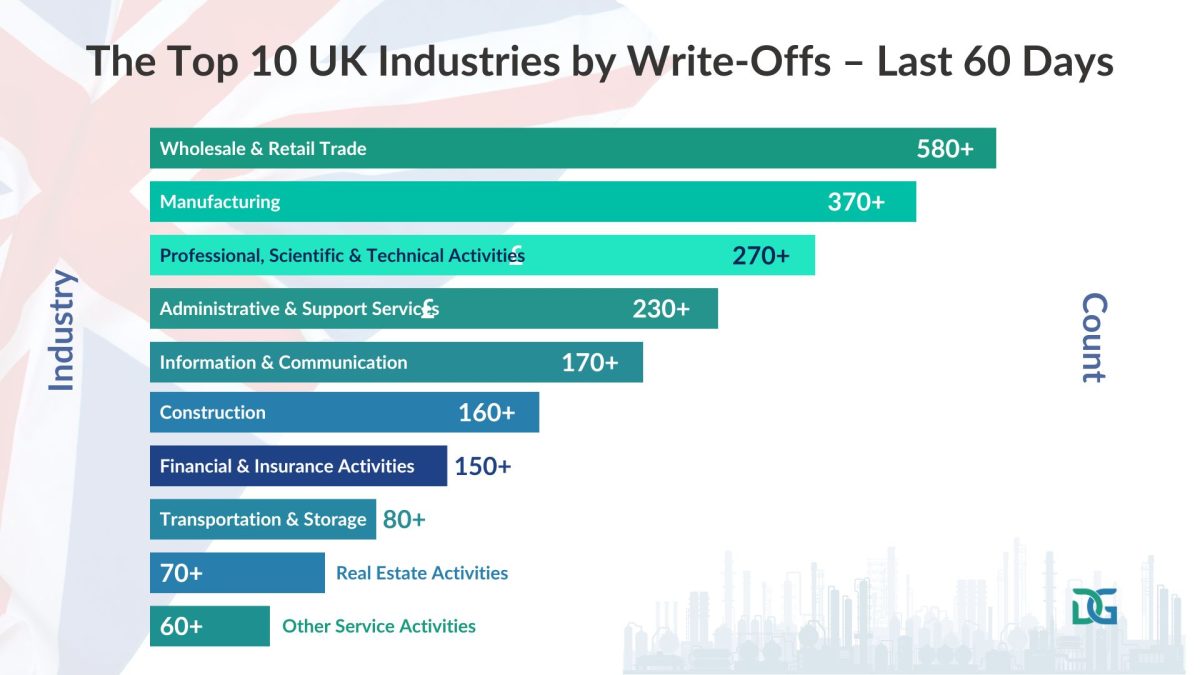

The Top 10 UK Industries by Write-Offs – Last 60 Days

Data Source: DataGardener (covering 5 million+ live UK companies)

Want More Data on UK Company Write-Offs?

Book a free demo to access deeper insights on recently affected companies, including industry trends, regional breakdowns, and risk analysis.

Regional Breakdown

Why do regional insights matter?

Although your sector appears stable overall, specific geographies are exhibiting signs of heightened vulnerability. Monitoring this helps with targeted risk reduction and localised decision-making.

Here is the updated and more detailed version of each industry section. Now every sector includes:

- Total write-offs count

- Top 5 affected regions

- Observations and insights

- Actionable pro tips

Top 5 Locations Affected per Industry

1. Wholesale & Retail Trade

Wholesale & Retail Trade saw the highest impact, with 585 businesses written off, accounting for 24.34% of all cases.

This sector tops the list, with nearly 1 in 4 business closures linked to wholesale and retail trade. Shifts in consumer behaviour, rising operational costs, and supply chain delays are creating a volatile environment, especially for independent retailers and regional wholesalers.

Top 5 Risk Regions:

Insight: These closures aren’t just small corner shops. Several mid-sized chains and online retail startups have also folded due to mounting overhead and competition from bigger players.

Pro Tip (for suppliers and B2B creditors): Before issuing trade credit, overlay SIC code and postcode-based risk maps to identify potential churn zones.

2. Manufacturing

Manufacturing followed closely, with 371 company closures, making up 15.44% of the total write-offs.

The UK manufacturing sector remains under pressure from supply chain shortages, import and export delays, and fluctuating energy costs. Many closures are occurring among small and medium-sized enterprises (SMEs) with narrow working capital margins.

Top 5 Risk Regions:

Insight: Yorkshire & Humber’s high manufacturing concentration is now a vulnerability, particularly in metal fabrication, plastics, and textiles.

Pro Tip (for lenders): Utilise sector-specific credit risk overlays for firms with high capital expenditures (CapEx) but low working capital resilience.

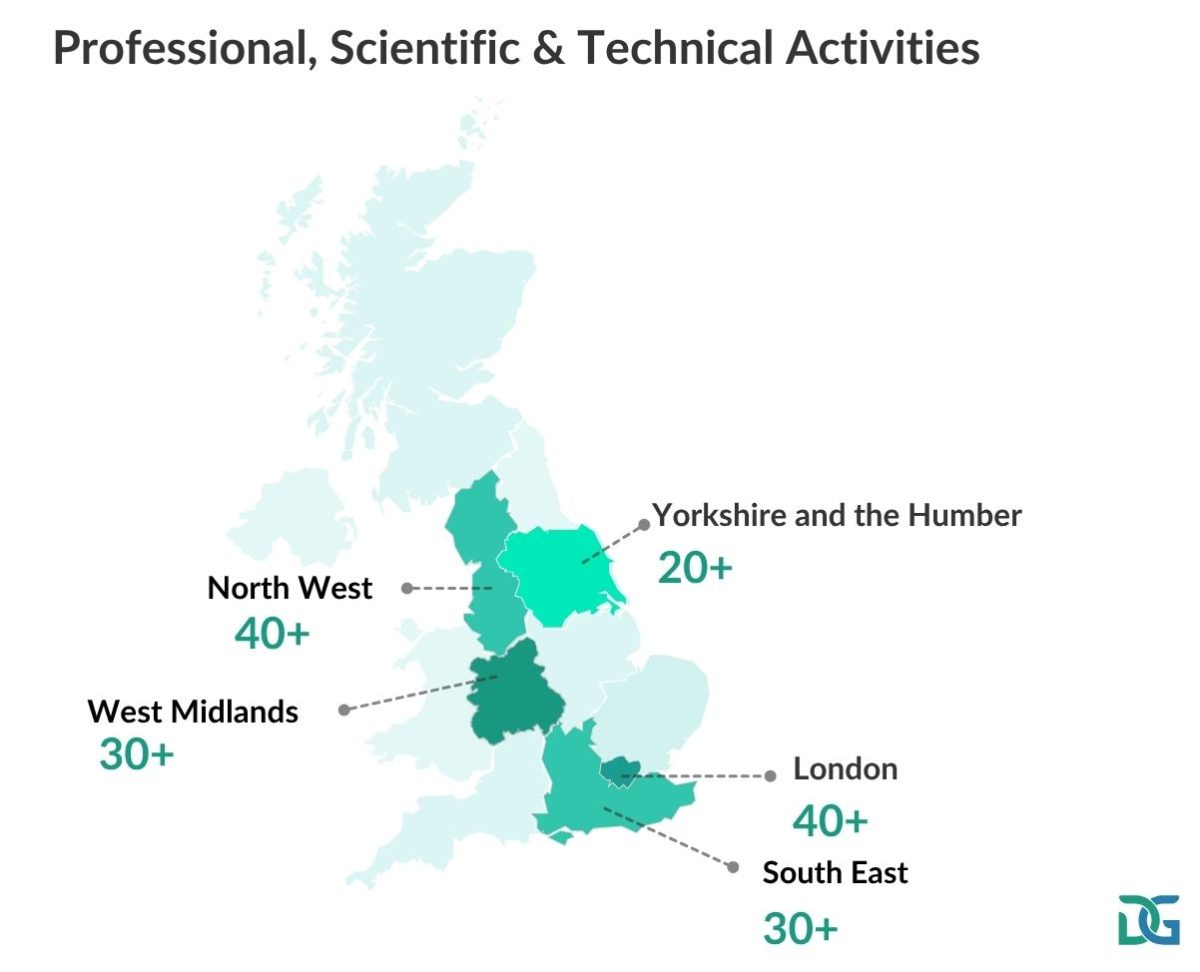

3. Professional, Scientific & Technical Activities

Professional, Scientific & Technical Activities experienced 273 write-offs, representing 11.36% of the overall count.

Often considered a stable services sector, this category encompasses consultants, engineering firms, research and development (R&D) providers, and legal and accounting practices. Write-offs are likely linked to delayed contracts, funding loss, and freelancer-heavy models.

Top 5 Risk Regions:

Insight: With many of these businesses depending on project-based billing, a single delayed invoice or contract can be fatal.

Pro Tip: Look for signs of deteriorating debtor days in quarterly accounts before engaging them in new deals.

4. Administrative & Support Services

Administrative & Support Services faced 232 business write-offs, contributing 9.65% to the total.

This sector includes facility management, recruitment firms, call centres, travel agencies, and more. Most companies here have lean financial structures and are heavily dependent on demand.

Top 5 Risk Regions:

Insight: Recruitment agencies and outsourced service firms are particularly exposed when corporate clients cut costs.

Pro Tip: High headcount with low asset backing? Red flag. Check insolvency trends on similar SIC codes before signing long-term contracts.

5. Information & Communication

Information & Communication recorded 175 affected companies, which is 7.28% of all write-offs.

Despite digital-first advantages, IT service providers, small software firms, and digital agencies are under growing pressure. Funding fatigue, client churn, and pricing wars have led to numerous collapses.

Top 5 Risk Regions:

Insight: Early-stage digital agencies and SaaS businesses with poor cash buffers are the most vulnerable.

Pro Tip (for VCs & tech lenders): Monitor terminations of director appointments and creditor notices; these as early red flags in this space.

Want a Customised View for Your Sector?

This report is just a snapshot. At DataGardener, we monitor over 5 million live UK companies with deep insights across:

- What’s happening in your sector

- How companies are doing financially

- Risk levels of businesses

- County/region-level segmentation

- Who owns or runs the companies

Want to see data for your sector?

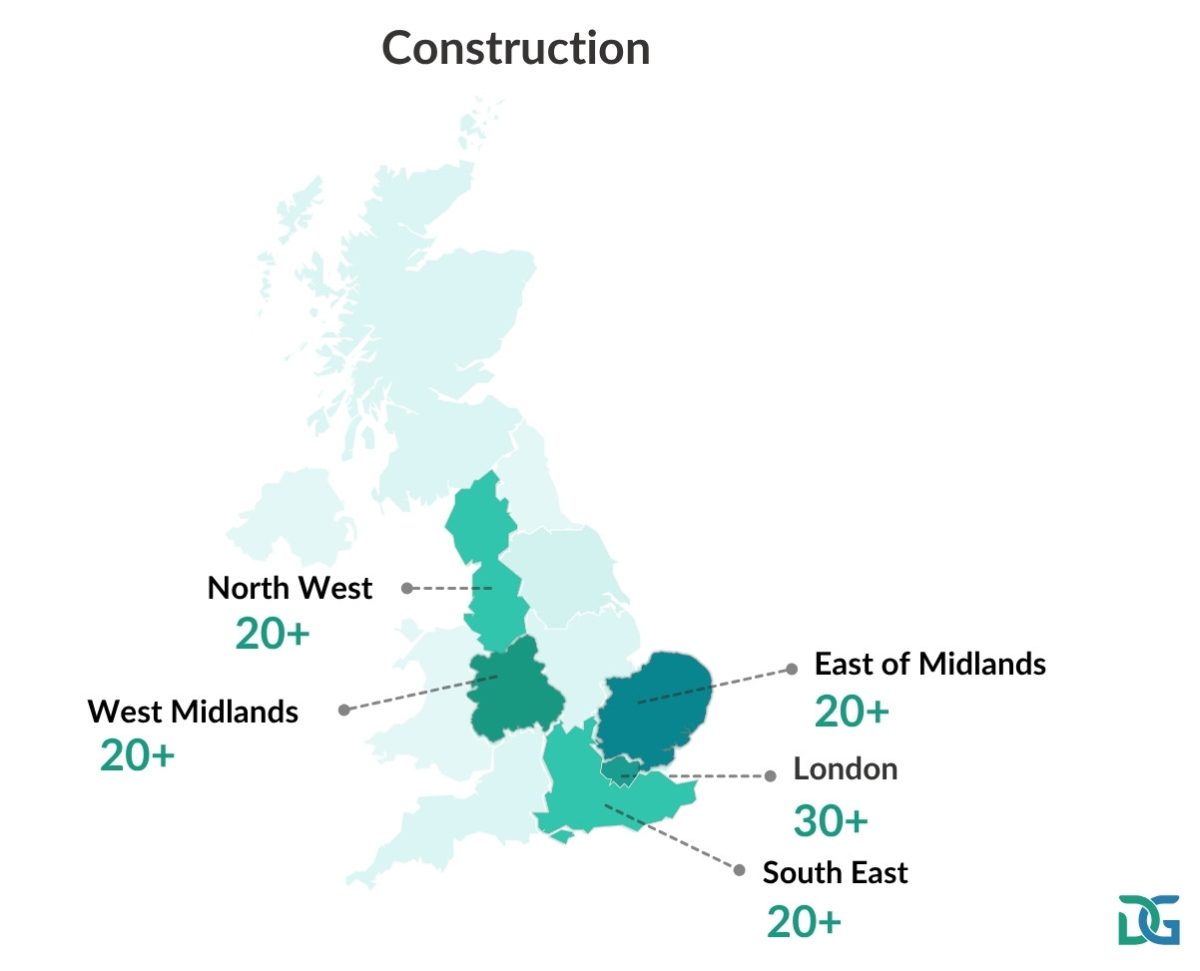

6. Construction

Construction reported 167 business closures, accounting for 6.95% of the total.

Construction companies are facing cash flow traps due to material price spikes, workforce shortages, and delayed payments from both public and private clients.

Top 5 Risk Regions:

Insight: Firms that rely on subcontractor-heavy models and fixed-bid contracts are at higher insolvency risk.

Pro Tip: Use contract value-to-debt ratios to assess vulnerability before entering into joint ventures or procurement contracts.

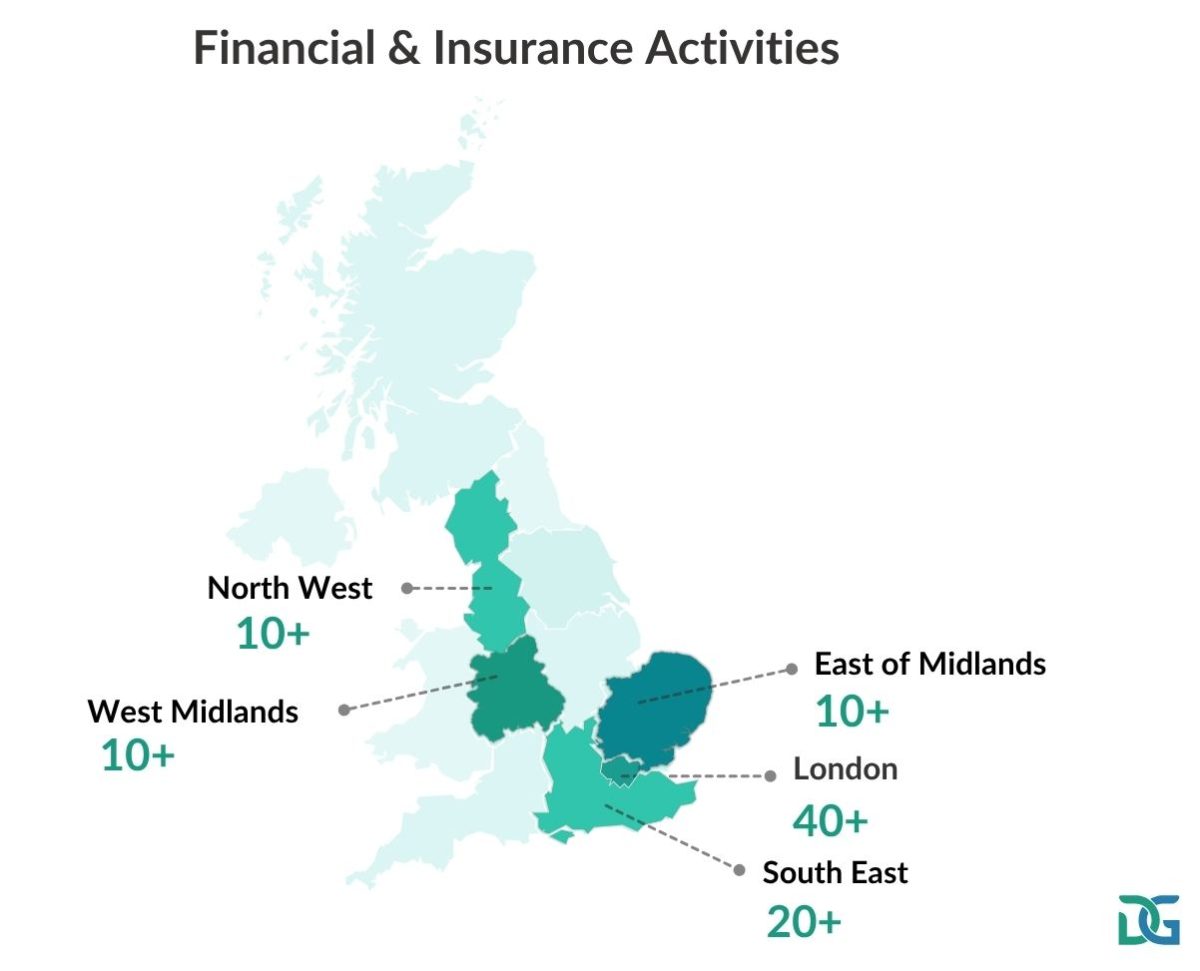

7. Financial & Insurance Activities

Financial & Insurance Activities saw 153 companies written off, representing 6.37% of the cases.

Brokerages, independent financial advisors (IFAs), micro-credit providers, and fringe lending entities are experiencing rising write-offs, possibly due to regulatory tightening and margin compression.

Top 5 Risk Regions:

Insight: The rise in closures is disproportionately affecting smaller firms with an annual turnover of less than £1 million.

Pro Tip: Monitor changes in FCA licensing status as a leading indicator of instability.

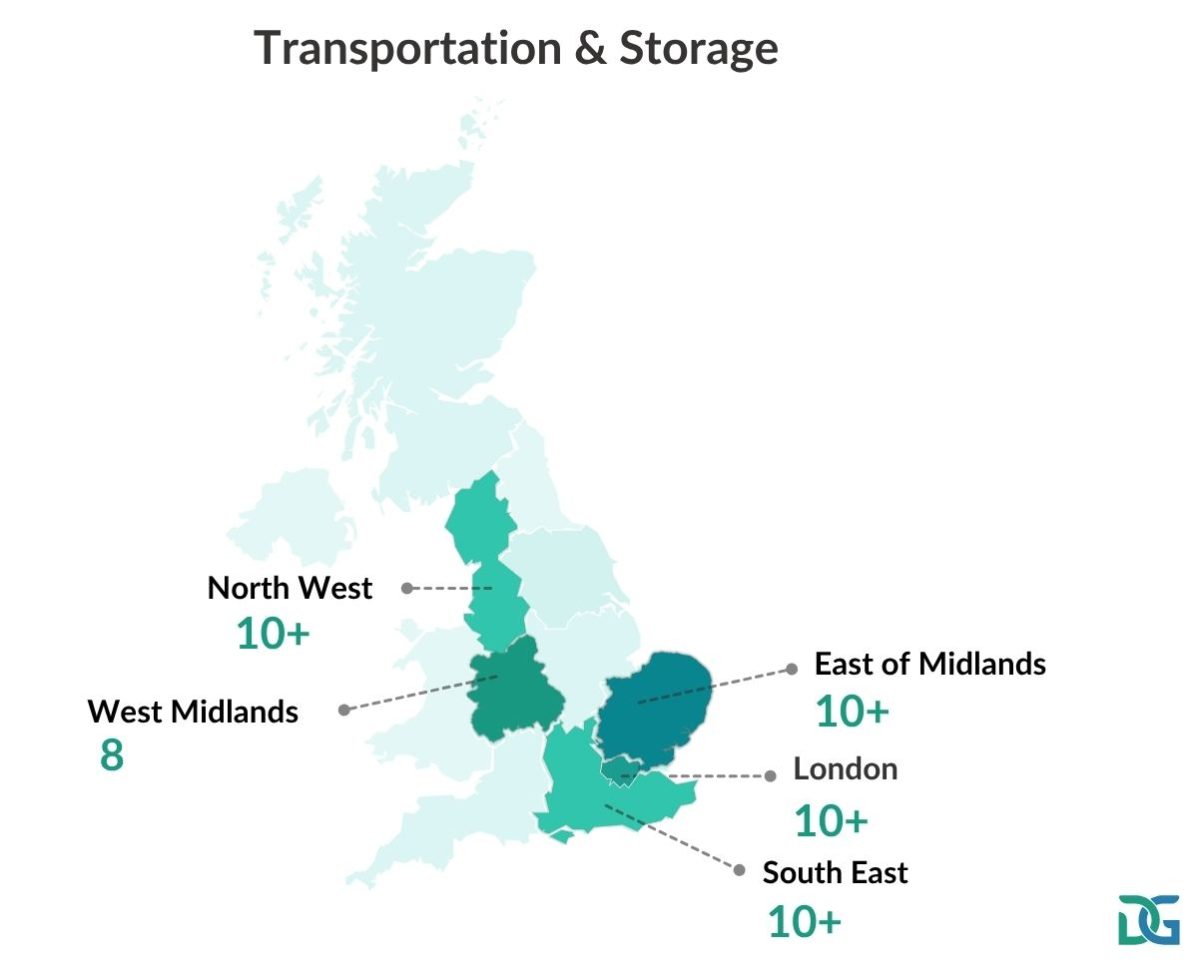

8. Transportation & Storage

Transportation & Storage experienced 85 business write-offs, contributing 3.54% to the overall figures.

Fuel cost inflation, insurance costs, and increased competition are weighing heavily on fleet operators and warehouse firms.

Top 5 Risk Regions:

Insight: Many closures are in micro-logistics and short-haul firms that have struggled with driver retention and erosion of profit margins.

Pro Tip (for logistics partners): Track chargeback patterns and HMRC late filing warnings before onboarding to ensure a smooth process.

9. Real Estate Activities

Real Estate Activities were impacted by 78 company closures, accounting for 3.25% of total write-offs.

Firms in property leasing, residential sales, and commercial brokering are feeling the squeeze from high borrowing rates and transaction slowdowns.

Top 5 Risk Regions:

Insight: Agencies operating in prime zones but reliant on commissions are closing due to sudden declines in deal volume.

Pro Tip: Avoid long-term service contracts with unincorporated estate firms that lack a recent revenue history.

10. Other Service Activities

Other Service Activities had 65 businesses written off, making up 2.7% of all recorded cases.

Includes personal care, fitness centres, events, education support, and non-profits. The majority are sole traders or micro-firms operating in hyperlocal geographies.

Top 5 Risk Regions:

Insight: Cost-of-living pressures have reduced discretionary spending, directly hitting these service providers.

Pro Tip: Cross-reference community funding status or charity income declarations before forming B2B relationships.

What Does the Risk Profile Tell Us?

This risk assessment applies across all industries, not just the top 10.

- Very Low Risk – 1,151 businesses (47.9%)

- Low Risk – 747 (31.09%)

- Moderate Risk – 347 (14.44%)

- High Risk – 52 (2.16%)

- Very High Risk / Not Scored – 106 (4.41%)

Insight: Surprisingly, nearly 79% of the businesses that were written off had been marked as low to very low risk just months earlier. This shows how relying only on outdated financial reports or static credit scores can be misleading. While many companies may appear stable on paper, a notable number still fall into the moderate to very high-risk category, raising the chances of unexpected debt write-offs in the UK.

Why This Matters

Whether you’re a:

- Lender or Credit Provider – you could be funding companies that look healthy today but are at risk tomorrow.

- Procurement Manager – supplier failure could jeopardise your entire supply chain.

- Investor or Advisor – you need better foresight to spot weak links early.

Create Your Own Top 10 Lists with DataGardener

Found these insights useful? This is just the beginning.

With DataGardener, you can build your own top 10 lists — whether it’s by industry, risk level, company size, or regional impact. Want to explore the sectors facing the highest write-offs in the UK? Or monitor financial health trends across 5 million+ active UK companies?

We can help you find exactly what you’re looking for.

Just fill out the form below, and our team will get in touch with you for a personalised walkthrough.

Conclusion

The last 60 days have revealed key patterns across UK industries, with Wholesale & Retail Trade, Manufacturing, and Professional Services facing the highest number of company write-offs. These insights highlight the importance of regularly monitoring business health, not just at the national level, but also across specific regions and sectors. Understanding which industries are most affected can help lenders, investors, and business leaders make more informed, data-driven decisions. With risks ranging from very low to very high, access to up-to-date company data is more critical than ever.