What the 2025 Data Reveals About the Year Ahead

As the UK moves beyond 2025 and into a defining year ahead, one reality is becoming increasingly clear. This is no longer an economy driven by volume alone. It is an economy shaped by selective growth, rising financial pressure, and an urgent need for resilience.

Entrepreneurs are still launching new ventures, investors remain active, and innovation continues to flow across sectors. Yet beneath the surface, the signals tell a more sobering story. Success in 2026 will depend less on how many businesses are created and far more on how effectively they convert early momentum into durable, well-governed growth.

Drawing on the DataGardener Annual UK Market Report 2025, this article explores the key insight company UK leaders, policymakers, lenders, and advisers need to understand as they plan for the year ahead.

Why 2025 Feels Fundamentally Different

Unlike the rapid rebound years that followed the pandemic, 2025 has been defined by deliberate, strategic decision-making rather than urgency-driven expansion.

Company formation volumes remain high, yet dissolution figures underline a harsher operating environment. More than 809,403 new companies were incorporated during the year, while over 11.4 million businesses were dissolved across the broader dataset.

This is not a downturn. It is a period of selection.

The businesses that continue to progress are those demonstrating capital discipline, governance maturity, and clarity of market positioning. Others, despite activity, are struggling to sustain momentum.

For anyone seeking insight company UK data that goes beyond headline numbers, this distinction matters more than ever.

Think Data. Think DataGardener

DataGardener users double their leads and cut research time in half — with smarter data, faster insights, and better decisions.

Where UK Business Is Structurally Concentrated

Using DataGardener’s IS-8 sector framework, the UK economy continues to cluster around four dominant sectors:

- Professional and Business Services

- Creative Industries

- Digital and Technologies

- Financial Services

These sectors account for the majority of company populations, new incorporations, borrowing activity, and CCJ incidence. Together, they form the backbone of the modern UK economy.

Smaller strategic sectors such as Clean Energy Industries, Life Sciences, and Advanced Manufacturing remain nationally important, but they represent a much smaller share of total companies.

This imbalance reinforces a long-standing truth: the UK remains, above all, a services-led economy. For insight company UK research, understanding this concentration is critical when assessing growth sustainability and risk exposure.

Regional Patterns: Where Activity and Pressure Travel Together

Geographically, the UK economy is not fragmenting, but it is becoming increasingly polarised.

London remains the country’s commercial epicentre, leading consistently in company formation, borrowing volumes, and legal stress indicators. The South East and North West follow closely, forming the UK’s primary economic triangle.

These regions combine opportunity with intensity. Where activity is highest, exposure to capital dependency and financial pressure is also most visible.

By contrast, regions such as Wales, Northern Ireland, and parts of the North East show lower absolute volumes but steadier participation. These markets tend to be smaller in scale, but often less volatile.

From an insight company UK perspective, this highlights the growing divide between high-pressure growth hubs and slower-burning regional economies.

How Healthy Is Growth in 2025?

Headline growth numbers only tell part of the story. When growth quality and risk are examined together, a more selective picture emerges.

Across the combined 2019–2025 dataset, DataGardener identified:

- 63,382 companies showing Excellent growth quality with Low Risk

- 11,732 companies showing Emerging growth with High Risk

- 1,924 companies showing Excellent growth with High Risk

These figures reveal that truly resilient growth remains scarce.

Many businesses are expanding, but a significant proportion are doing so while carrying elevated legal or financial exposure. Growth in 2025 is increasingly something to be managed, not celebrated.

For organisations seeking insight company UK intelligence, this distinction between growth volume and growth quality is central to effective decision-making in 2026.

Capital Is Flowing, but Resolution Is Lagging

Borrowing remains a defining feature of the UK business landscape.

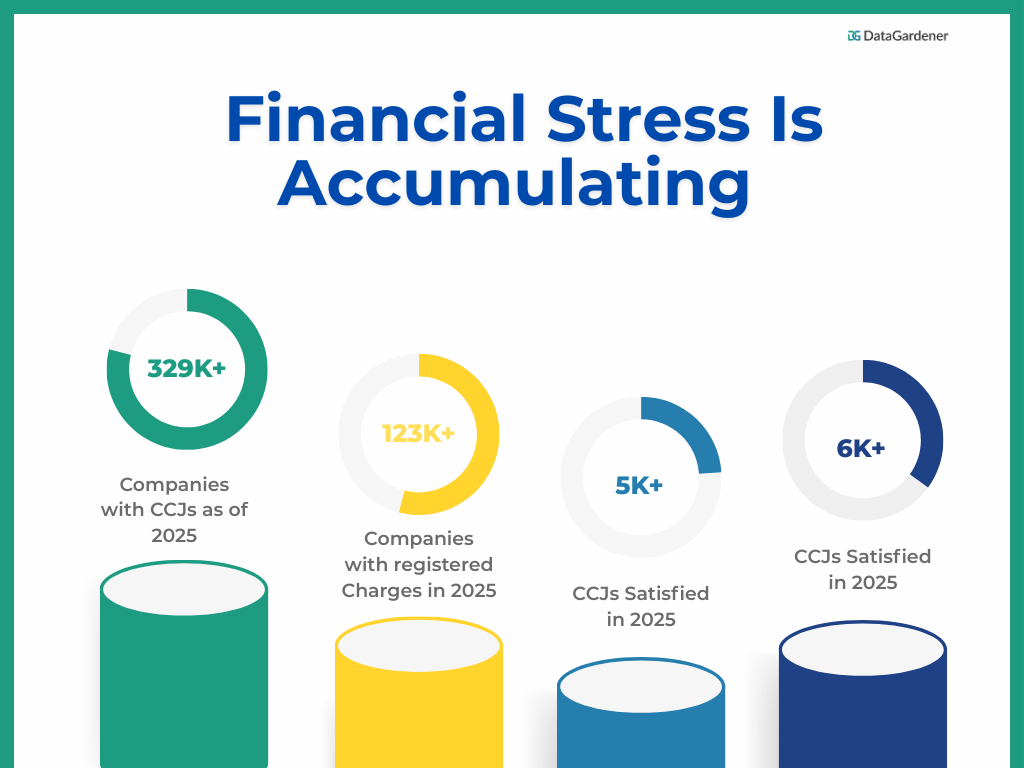

In 2025 alone:

- 101,809 companies held registered charges

- 329,514 companies had at least one CCJ

- Only 5,649 CCJs were satisfied during the year

This imbalance highlights a market where financial pressure is building more quickly than it is being resolved. Many firms continue to operate and borrow while unresolved legal stress accumulates quietly in the background.

It is a reminder that growth and fragility often coexist, particularly within capital-dependent and early-stage businesses.

MSMEs: Where the Real Economy Lives

The UK economy remains dominated by Micro and Small Enterprises, and this structure has not materially changed.

Between 2019 and 2025:

- Over 1,304,272 companies operated at micro scale

- Around 69,740 companies fell into small enterprise bands

- Only 14,081 companies reached medium size

- Just 5,687 companies operated at enterprise scale

Most businesses start small. Very few ever scale.

This narrow scaling funnel explains why financial vulnerability remains concentrated at the smallest end of the market. Micro businesses drive innovation and experimentation, but they also face the highest exposure to cash-flow volatility, borrowing dependency, and external shocks.

For anyone analysing insight company UK data, the scale-up bottleneck remains one of the most persistent structural challenges.

Leadership Signals Are Increasingly Decisive

Leadership dynamics are becoming a stronger differentiator between companies that progress and those that stall.

In 2025, the director population included:

- More than 572,486 male directors

- Over 239,179 female directors

Director entry continues to track company formation closely. However, businesses led by experienced directors with exposure to multiple business cycles are far more likely to appear in strong growth, low-risk categories.

Governance quality is no longer a secondary consideration. It is a defining factor in business resilience.

Female Founders: Strong Participation, Limited Scale

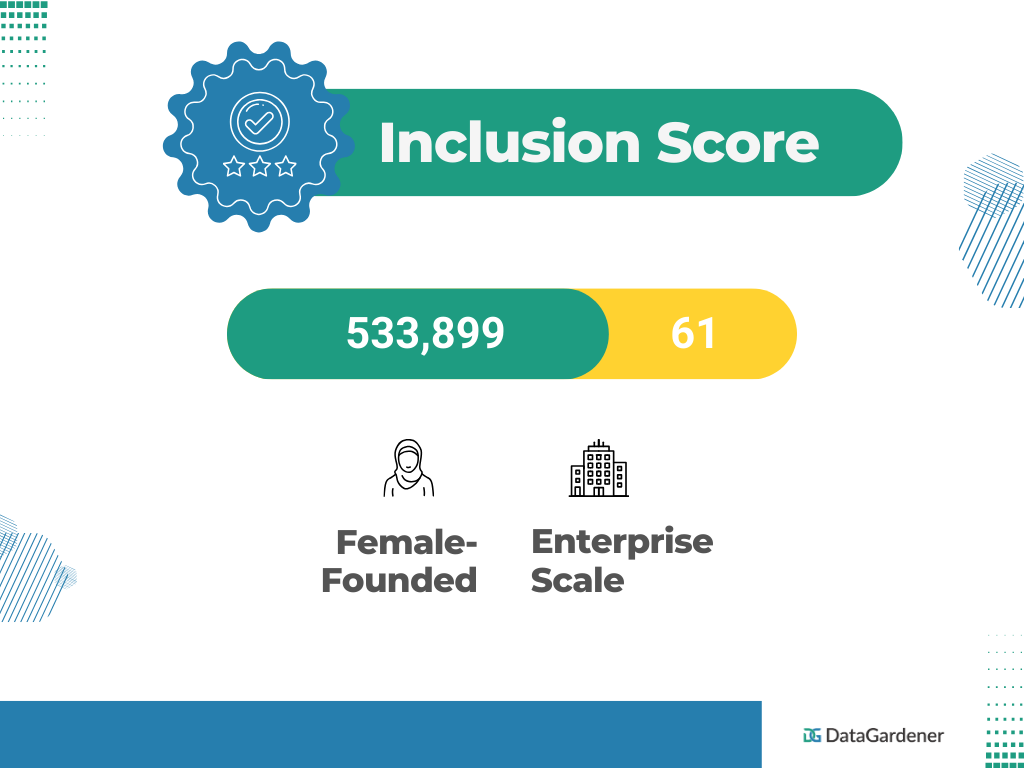

Female entrepreneurship remains a vital component of the UK business ecosystem.

Across the 2019–2025 dataset:

- 532,994 female-founded companies were identified

- 135,259 female-founded businesses were formed in 2025 alone

Participation is strong, but progression remains constrained. Only 61 female-founded companies operate at large enterprise level.

High-quality growth signals are also under-represented among female-led firms. This reflects structural barriers around capital access, networks, and governance support rather than a lack of ambition.

Inclusive growth in 2026 will depend on addressing these progression gaps, not increasing participation alone.

What This Insight Company UK Data Tells Us About 2026

The evidence points to a UK economy entering a period of selective acceleration.

2026 is unlikely to be defined by a surge in new company formations. Instead, it will be shaped by which businesses can:

- Convert early momentum into durable growth

- Manage capital without compounding legal stress

- Strengthen governance as they scale

- Access the right support at the right time

Companies currently classified within the Emerging growth and High Risk cohort represent the single largest opportunity for intervention. With targeted finance, advisory support, and governance frameworks, many could transition into resilient growth paths.

Without intervention, they are the most likely contributors to future dissolution figures.

Final Thoughts

The UK business economy is not slowing down. It is becoming more selective.

Entrepreneurship remains strong, but survival and success now depend on progression quality, not formation volume. Growth, risk, and resilience are no longer evenly distributed. They are measurable, visible, and increasingly predictable when viewed at company level.

Businesses and institutions that embrace data-driven insight company UK intelligence and act with precision will be best positioned to thrive in 2026.

All insights are sourced from DataGardener’s UK Market Intelligence datasets.

For deeper insight, explore and download the complete DataGardener Annual UK Market Report 2025.