A Month of Strategic Shifts and Steady Growth

November marks a period of strategic recalibration, as businesses wrap up the final quarter, prepare budgets, and position themselves for a strong start to 2026.

Did you know?

November consistently shows strong company activity in the UK, with both incorporations and restructurings reflecting year-end momentum across multiple sectors.

This month’s DataGardener UK business insights report uncovers the key trends, risks, and opportunities shaping the UK business landscape. Make your next move informed. Start with insight.

Business Overview

As of November 2025:

These figures highlight a steady yet cautious business climate, with entrepreneurs remaining active while exercising more calculated decisions as the year nears its close.

Key Figures:

- 58.2K+: Companies Registered

- 13.06K+: Charges Registered

- 10.6K+: CCJs Filed

Company Dissolutions – November 2025 vs October 2025

How many companies closed down in November?

In November 2025, over 56.5K+ companies were dissolved, a moderate increase compared to 52.7K in October.

This likely reflects seasonal consolidations, year-end restructuring, and post-summer business evaluations, as organisations tidy up operations before closing the books.

Total Count:

Think Data. Think DataGardener

DataGardener users double their leads and cut research time in half — with smarter data, faster insights, and better decisions.

Businesses Incorporated – November 2025 vs October 2025

How did new company formations compare to October?

In November 2025, 58.2K+ companies were incorporated — a 19.4% decrease compared to 72.2K+ in October.

Despite this dip, incorporation rates remain resilient, suggesting ongoing business confidence as the UK economy steadies into Q4.

Regional Distribution:

- London: 19.6K+ companies, retaining its dominant position

- North West: 5.9K+, showing strong regional momentum

- Wales: 1.1K+

- Northern Ireland: 0.7K+

📍 London continues to dominate as the UK’s commercial hub, while regional economies, particularly in the North, maintain steady momentum.

New Companies Registered in November 2025

Industrial Distribution – Top 10 Industries

The SIC analysis for November 2025 shows a balanced distribution of new company formations across key sectors.

- Wholesale and Retail Trade leads with 19.14%, reflecting sustained demand and entrepreneurial activity.

- Real Estate (10.39%) and Professional, Scientific and Technical Services (10.51%) follow closely, driven by continued investment and consultancy growth.

- Information and Communication (8.89%) and Construction (7.41%) remain solid contributors, highlighting the resilience of tech and infrastructure-led businesses.

💡 Overall, November’s trends reflect steady confidence across core industries, particularly those adapting quickly to digital and market shifts.

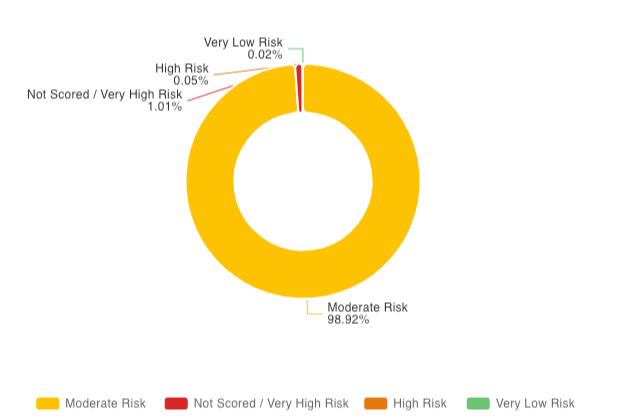

Risk Assessment of Companies Incorporated in November 2025

What does the risk profile of new companies tell us?

Risk analysis shows a predominantly stable business environment:

- Moderate Risk: 98.92% (57,587 companies)

- High Risk: 0.05% (29 companies)

- Very Low Risk: 0.02% (11 companies)

- Not Scored / Very High Risk: 1.01% (590 companies)

These figures suggest that most new businesses are adopting measured financial strategies, reflecting steady confidence and prudent management as the year progresses.

Charges Registered – November 2025 vs October 2025

Were there changes in company charges registered?

In November 2025, 13.06K+ outstanding charges were registered, slightly lower than 14.4K+ in October.

This aligns with slower lending and investment activity as firms consolidate financial positions before the fiscal year-end.

County Court Judgments (CCJs) – November 2025 vs October 2025

How did CCJ filings trend in November?

Over 10.6K+ CCJs were filed in November, compared to 8.7K+ in October.

📊 The stability signals strong credit discipline and prudent credit management across UK businesses.

Female Founders

How are female founders performing?

In November 2025, over 0.4K companies were registered as female-owned, a decrease from 9.3K in October.

Top 3 industries for female-owned businesses:

Top 3 regions for female-owned businesses:

💡 Despite the seasonal slowdown, female founders continue to represent a vital and resilient segment of the UK entrepreneurial base.

Conclusion: What does November 2025 tell us about the UK business landscape?

November 2025 paints a picture of measured confidence and strategic recalibration.

- Entrepreneurs remain active

- Investors continue to participate

- Companies are managing risk carefully, reflecting maturity and resilience in the UK’s evolving business ecosystem

While incorporations and dissolutions indicate ongoing market activity, the data shows businesses are adopting prudent financial strategies, consolidating positions, and planning thoughtfully for the year ahead.

Female entrepreneurship continues to be an important segment, contributing to diversity and innovation across multiple industries and regions.

As the year comes to a close, one thing is clear:

Businesses that combine data-driven insight with strategic timing will be best positioned to thrive in 2026.

📈 All insights are sourced from DataGardener’s November 2025 UK Business Insights Report.

For deeper data, API access, or customised dashboards, check with your expert at DataGardener.