Understanding more about your statutory accounts can be a bit challenging, especially if you don’t have a financial background. It is important to understand the basics of company accounts, no matter if you are an experienced business owner or a new entrepreneur settling down in the UK. Statutory accounts are like the crux, depicting how well your business is performing at that stage and at that time.

Here in this post, the focus is to help you comprehend and get clarity of the financials in your business. Do you know what is meant by company statutory accounts? They summarize the organization’s financial activity over the fiscal year or period of 12 months. Every year, the reports are prepared for limited company accounts information and submitted at Companies House and HM Revenue & Customs. The free statutory accounts information comprises of the following:

- Balance Sheet – This financial statement provides an insight into your company’s liabilities, assets, and the shareholder’s equity at a time. It represents the financial health of the company at the time when accounts were created and also helps in comparing what is owned versus owed.

- Assets – It is something that is either owned by the company or you can get advantage from. It can be a fixed asset or a current asset.

- Liabilities – It is more of an obligation, usually a debt that needs to be repaid. It can be a current liability or a long-term liability.

- Profit and Loss Statement – This statement is not the same as of the balance sheet. It explains about the company’s performance over the period. You can see the total expenses and the total revenue of the business in the statement throughout the financial year.

- Cash Flow Statement – The purpose of this statement is to detail the company’s cash in and cash out movements over the fiscal year. Cash flow is the money amount that comes in and goes out during a financial year. The statement generally categorizes into three sections involving operating activities, financing activities, and investing activities.

Aside from these, there are other financial terms as well to comprehend.

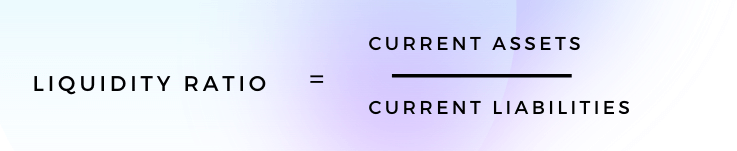

- Liquidity ratio – It enables to determine the company’s short-term viability and is calculated as per the following:

Liquidity Ratio = Current Assets/ Current Liabilities

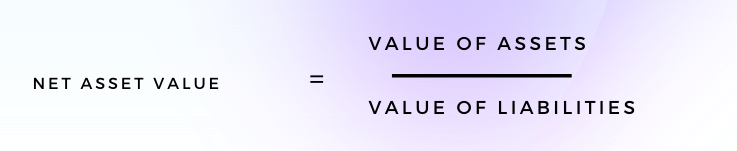

If the ratio<1, it can be bad. How to evaluate the value of your business? Here NAV (Net Asset Value) helps and is the right answer. It is calculated as follows:

- NAV = (Value of Assets) – (Value of Liabilities)/Total Share Outstanding

The NAV is expressed most of the time as the NAV per share. It is estimated as by taking NAV and then dividing it by the total number of shares in issue. If the NAV is higher than the share price, it might not be good and if it is less, it indicates that the market is expecting the company to make profits in the future.

The other key financials to understand include turnover, taxation, cost of sales, salaries, dividends, capital reserves and depreciation etc. It is a mandate to file at Companies House accounts information, and before you start, make sure to get your accounts approved by the company directors and then file them. At the end of the financial year, your private limited company must prepare to file a company tax return and statutory company accounts information with Companies House and HMRC.

At the end of the day, we all want our businesses to thrive and flourish. For business owners, entrepreneurs and investors, it means that having clarity of the enterprise through company accounts. DataGardener is an advanced business information platform helping professionals and business owners to look into the financials and company accounts data of organizations operating across different verticals. Feel free to apply the respective filter, be it industry type, financials, accounts category or anything else. And the platform is helping you in accessing information related to the following:

- Statutory Accounts – It tells about the company’s turnover, total assets, total liabilities, and net worth through a graphical representation over the last 2-3 years.

- Ratios – It helps in getting an understanding of the company’s total debt ratio, current ratio, equity ratio and creditor days over the years.

- Profit and Loss Statement – It tells about the respective profit or loss over the 12-month time, depending on factors like turnover, depreciation or audit fees, etc.

- Balance Sheet – It tells about the assets and liabilities in detail.

- Capital and Reserves – It tells about the shareholder’s equity, share capital and more.

- Cash flow statement – It describes the cash movement over the year.

- Miscellaneous and other financial items – It tells about the net worth of the company, net assets, capital employed and so forth.

The statements can be downloaded for reference if required. Feel free to connect with the team for more details. The company accounts information can be rewarding in the long run, and in connecting with the right businesses to expand and grow.