Key Events of the Month

What’s happening in the UK – Even with Halloween on the horizon, October proved to be not as scary as some had feared for the UK economy. With the successful rollout of the COVID vaccine as well as the recently developed COVID anti-viral pill that reduces hospitalizations by up to 89%, the UK seems to be, as far as most are concerned, nearly back to normal.

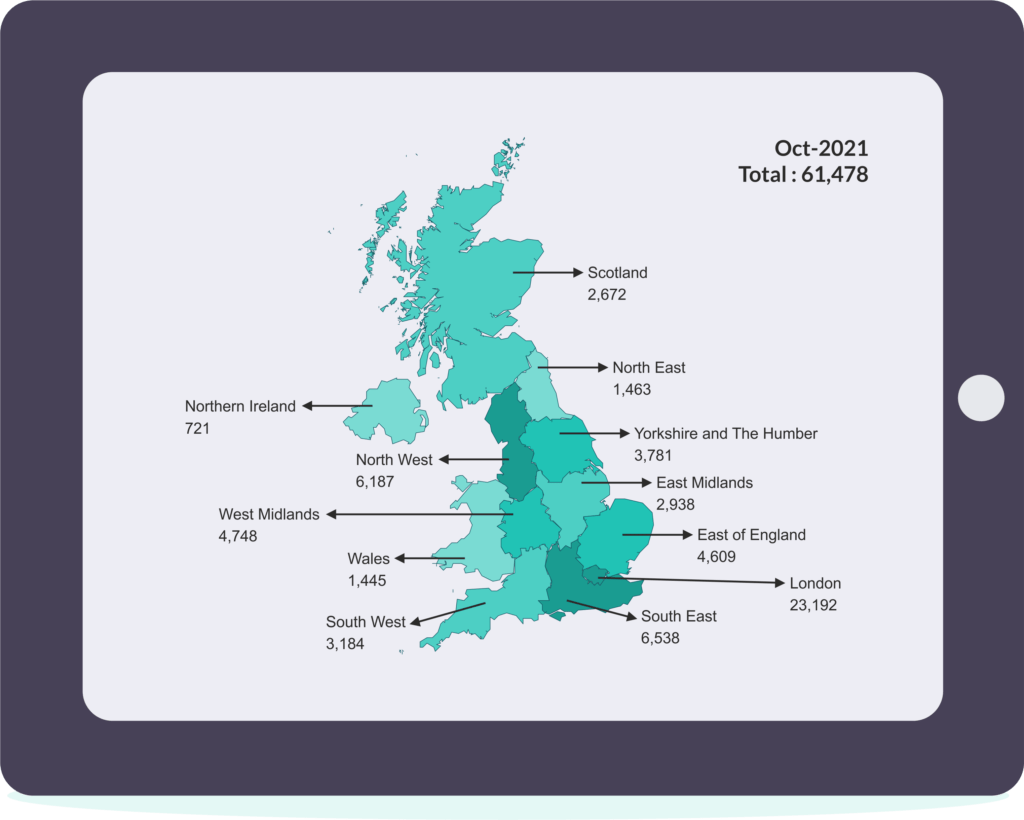

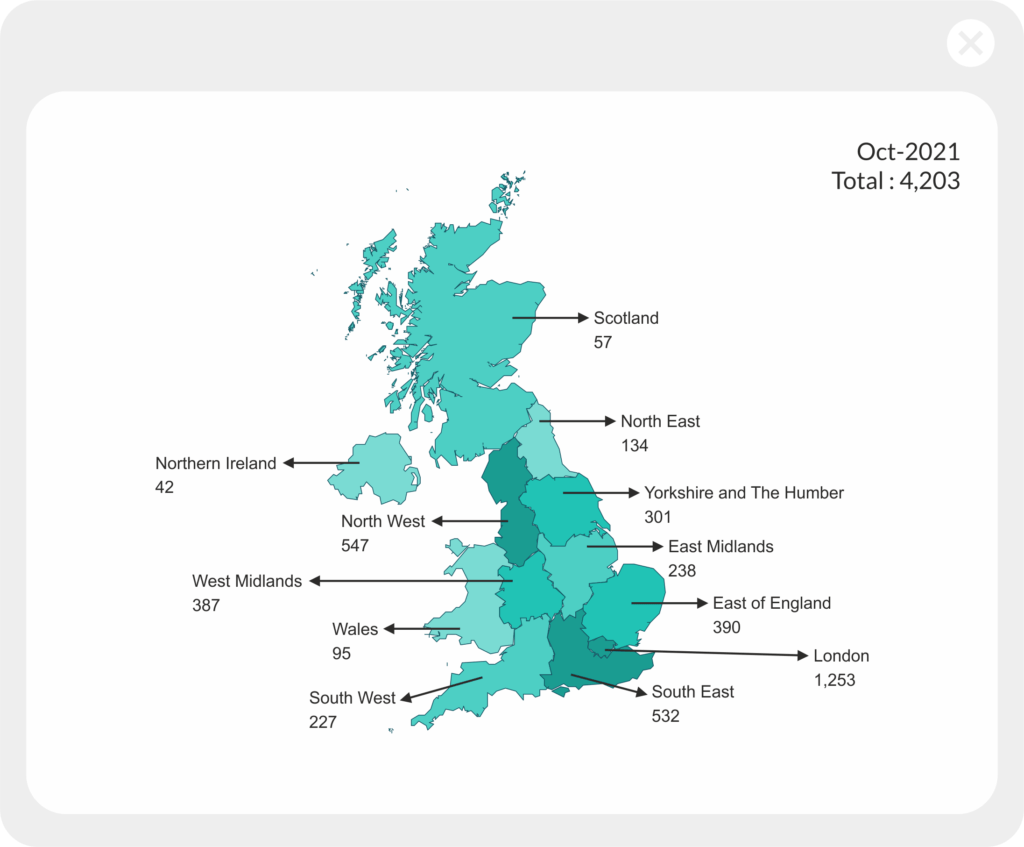

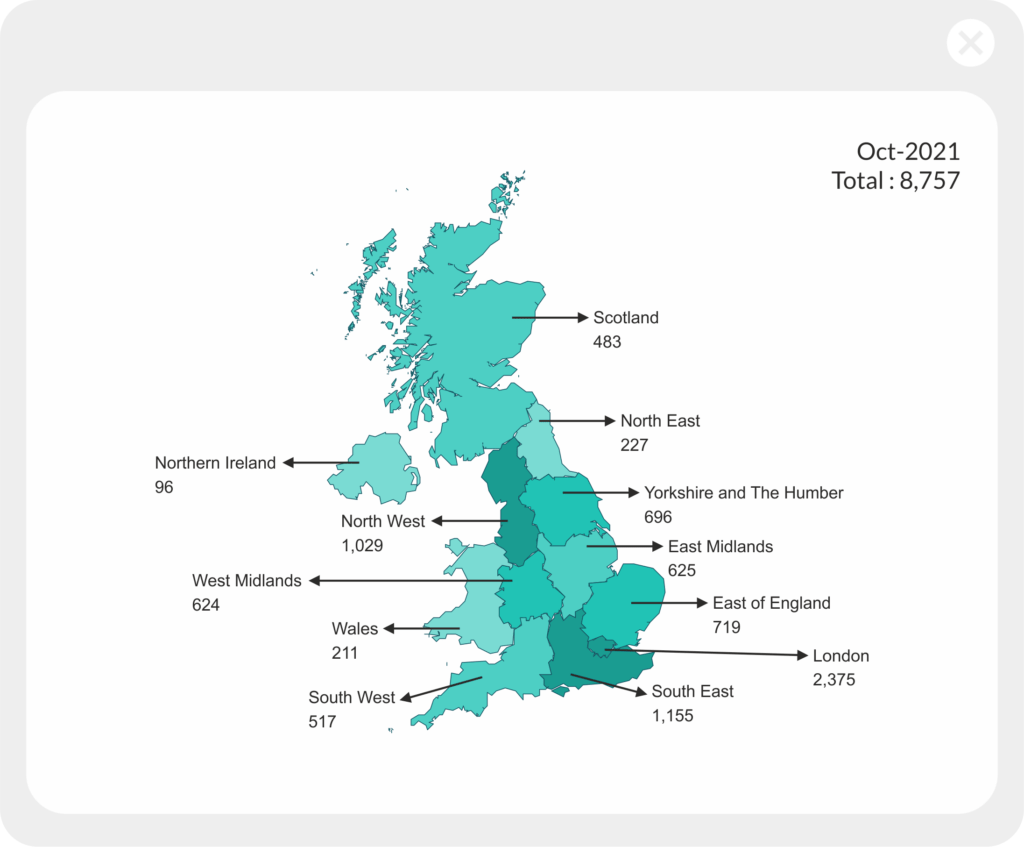

This normality is also reflected in the number of new companies formed, CCJs and charges registered throughout the month of October. A refreshingly normal 61,478 companies were formed this month, with 4,203 filed CCJs and 8,757 Charges registered. (Data Source – DataGardener platform)

An Eventful Month

In other news, the month has had both ups and downs for a variety of UK companies and industries, including a recent upswing in general economic growth as well as troubles in the steel industry and within the world of banking.

Although widespread disruption to supply chains proved to be a worry to business leaders and investors heading into October of this year, it seems to have not stopped the UK economy from growing by an above-average amount throughout the last three months. The Confederation of British Industry’s (CBI) monthly growth indicator estimates that UK economic growth rose from 27 to 29 in October, indicating remarkable resilience in the UK economy despite Brexit and the COVID crisis.

This is also including the petrol crisis that hit UK stations during the start and middle of this month, causing chaos for many who relied on the fuel for work and travel, possibly emphasizing the pressing need for alternative modes of fuel and transport. This approach to alternative fuels and carbon-neutral business models has been steadily increasing over the past year, with net-zero UK tech firms being valued at an overall £34.8 billion compared to a mere £17.8 billion the year prior.

This means that net-zero companies have more than doubled their value over the past 12 months despite a slow in investment growth.

The potential of net-zero companies to help save the planet has attracted huge amounts of attention, with some calling for the UK to stimulate more growth in these sectors through government grants. This would echo the actions of countries such as Sweden, which invest more than 10 times the amount in net-zero tech and companies per tonne of CO2 than any other country on earth.

In finance news, the Lithuanian-founded and London-based start-up Ondato raised £4.8 million for its fintech services over October, helping them grow rapidly in the UK. The company provides security and compliance services to banks and financial institutions as well as improved onboarding to allow these businesses to minimize manual work needed to onboard clients through artificial intelligence and automation. Companies and stories such as this further push the narrative that the UK and London are the best places in the world for fintech and innovation, further cementing London as the financial capital of Europe.

On the Road to Recovery?

Despite the positive economic news for the UK, the Bank of England has been under continuous financial pressure to hike interest rates in accordance with the current rise in inflation. This will come as a worry to many, especially after interest rates hit all-time lows during the pandemic, leaving people, especially homeowners, worried for their financial future. At this point in time, it’s not really a matter of whether the bank will increase interest rates but more a matter of when.

The economic recovery of the UK, although still above average, is showing signs of weakening after its peak in mid-august of this year, and with inflation set to peak at around 4-5%, an increase in interest rates is ideal for curbing this rise in inflation. As the UK recovers from COVID, the general public has more money to spend and are willing to spend it, especially considering previous lockdowns, pushing the prices of goods higher and higher.

The greatest problem with raising interest rates is the toll put on homeowners and those with significant mortgages. An increase in interest rates means an increase in mortgage cost, which could hit those who have already suffered economic loss as a product of the pandemic.

In a win for US-EU relationships, President Biden recently signed a deal to remove tariffs on steel coming from the EU, which were imposed by his predecessor Donald Trump in an effort to protect US steel manufacturers. In response to this gesture, the EU in turn, removed tariffs it had previously put on whisky, powerboats and Harley-Davidsons in retaliation to the steel tariffs. However, in light of Brexit, these deals have left the UK in the dark as the UK is no longer part of the EU, meaning tariff lifts from EU countries do not apply to the UK despite them being implemented when the UK was still part of the EU.

The trade body UK Steel comments that a need for a deal to be struck between the US and UK regarding these tariffs should be the top priority, as UK steel prices are now uncompetitive in the US compared to EU steel prices. Despite this, the news that the US and EU are freely trading steel should appease activists, as it avoids having to import dirty steel from China which accounts for over 20% of all CO2 emissions.

Overall, October saw steady improvements to the UK economy on the world stage, including an increase in overall growth as well as innovation in both the fintech and banking sectors. Despite worries about overall inflation, the Bank of England’s hike of interest rates should be enough to curb spending to reach the self-imposed 2% yearly target. With the festive season on the horizon for many faiths and creeds, the UK economy should see further stimulation over the next few months.