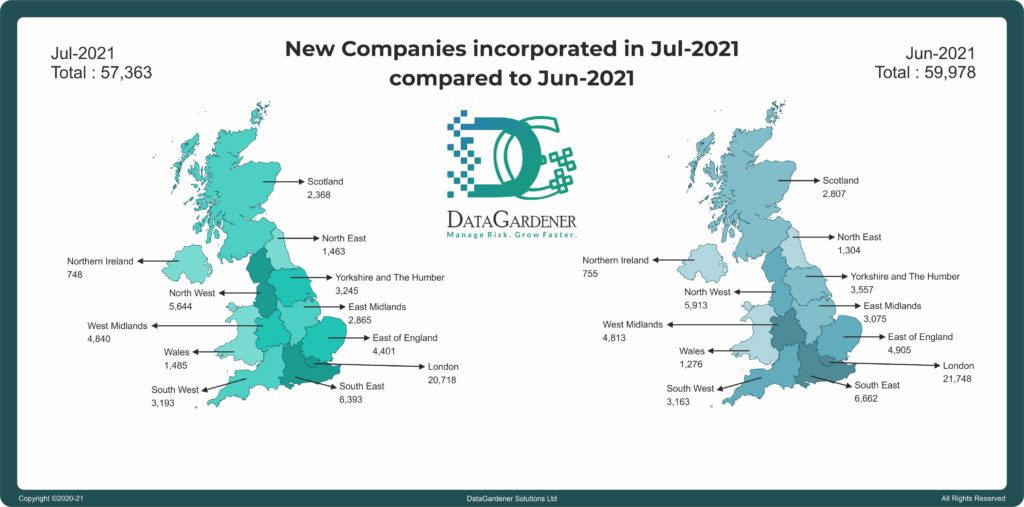

As expected, the month of July proved to be a tricky one for UK businesses once again faced with a COVID dilemma. In the midst of a third wave causing upwards of 50,000 new infections per day, workers in the service industry were particularly hard hit. Businesses were forced to decide between enforcing continual mask-wearing or allowing customers to enter their premises without any face coverings. Similarly, to the previous month of June, the numbers of new companies formed in July sat at a paltry 57,363. Despite this, there were big wins for certain regional areas such as Northern Ireland as well as specific sectors.

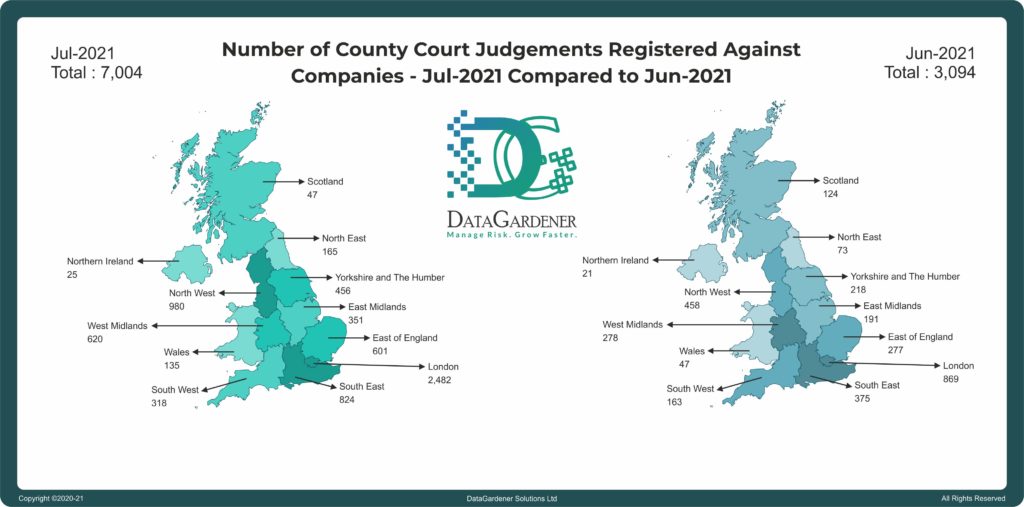

On a slightly less positive note, CCJs almost tripled from the previous month, with July seeing 7,004 CCJs filed across the UK, with London accounting for over a third of these with 2,482 filings alone. This rise may be connected to the huge amount of potential fraud committed via COVID business loans, which we discussed in our blog last month.

Despite being a challenging time for some UK businesses, especially those in the hospitality and service sector, certain industries have seen large recent upticks in investment. Most notably of these is the UK fintech industry which, by the 20th of July, had already hit a record yearly high. The sector has managed to raise an incredible $5.7 billion in the first half of this year alone, smashing the previous record of $4.9 billion recorded for the entirety of 2019. Although this is still far below the US record of $26.7 billion, it still places the UK as the second largest fintech industry in the world, even in the midst of a global pandemic. The banking and investment app Revolut raised $800 million alone from private investment, a big win for the industry considering that most fintech companies would have struggled to be included in the UK government’s new Future Fund, worth £375 million. In fact, many in the industry are hoping for the UK government to make remaining in the UK a more attractive prospect. This could be through greater access to international markets post-Brexit as well as driving reforms to make it more attractive for companies to list themselves on the LSE once they are large enough.

Although the country has seen some extensive recent political upheaval, Northern Ireland and its capital have recently been the subject of significant internal and international investment. Recent Brexit talks and deals between the UK and the EU have often treated the country as a contentious issue – as more of a pawn to be bartered than a country in its own right. This has caused significant upset in the region, and with the traditional ‘marching season’ about to go underway at the same time, tensions in the country are higher than ever. However, this hasn’t stopped the US banking giant Citigroup and local start-up FinTru from adding hundreds of jobs to the city of Belfast. This follows recent announcements from financial giants such as PwC, Deloitte and KPMG about creating 2,200 new jobs in the city over the next five years, significantly boosting the financial services sector. As a city whose rent runs less than a quarter of the rent of London and half the rent of Dublin, Belfast is in a prime place to develop alongside the investment of these large financial corporations, creating a city whose cheap living and real estate has the power to attract further large investment from other sectors beyond finance.

In other parts of the UK, there’s even more good news for businesses across sectors seeking private investment. In the current active market, private non-banking lenders are contributing to a strong overall liquidity alongside traditional bank financing. The volatile environment has also meant that mergers and acquisitions companies have been more in demand than ever, with the winners and losers of the COVID-19 pandemic all looking forward to how they can move on from such an unprecedented year. However, with such large changes taking place, lenders will want to be careful about who they end up lending their money to. Having so many options is making it difficult to conduct proper due diligence on every company that comes their way, meaning that business data services such as DataGardener have become more vital to lenders than ever. This is especially relevant to lenders who may want to make riskier investments on companies that were hit the hardest by the pandemic but may have a better long-term return on investment once COVID subsides.

Compared to previous months in 2021, July has signalled positive changes in the UK despite the peak of a third COVID wave. Last month’s huge rise in potential fraud within the COVID loan scheme still remains a concern, and a larger than the usual number of registered CCJs also seems troubling, but this hasn’t seemed to dissuade banks and private investors and lenders from investing in slightly riskier companies. This combined with the positive up-turn of investment in UK fintech companies and significant interest in Belfast, is a positive sign for UK businesses. However, with widespread fraud still a major worry for some lenders, some uncertainty still may be on the horizon.