Key Events of the month

Despite the ongoing Ukraine crisis, April has marked one of the more stable months so far in 2022. Since the beginning of the war in February of this year, the effects of the conflict on supply lines, goods and services have already taken place. Thankfully, most of these effects were less disruptive than originally thought, primarily down to the re-conquering of Ukrainian territory – mostly farmland in the east – previously held by Russia.

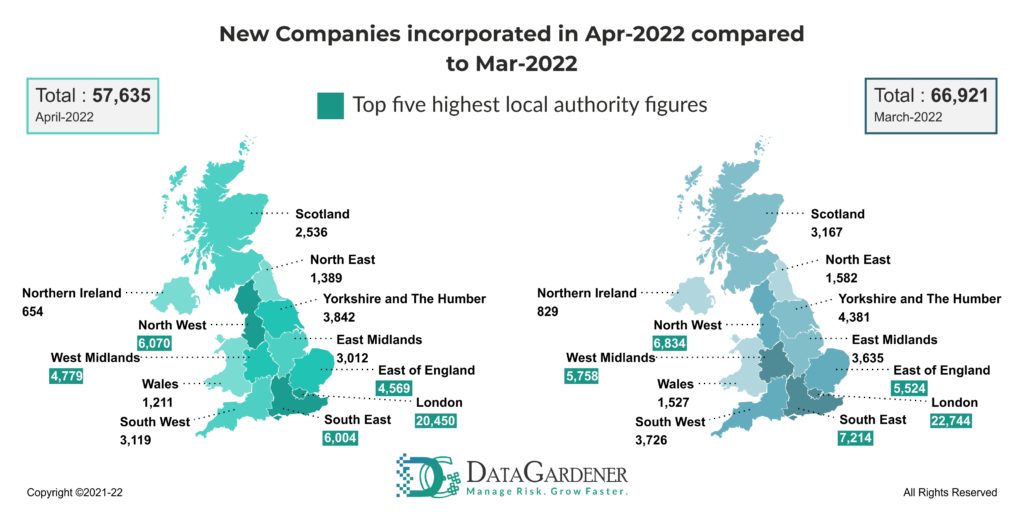

However, the beginning of the financial year still saw fewer companies formed than in previous months, with 57,635 companies being formed in April:

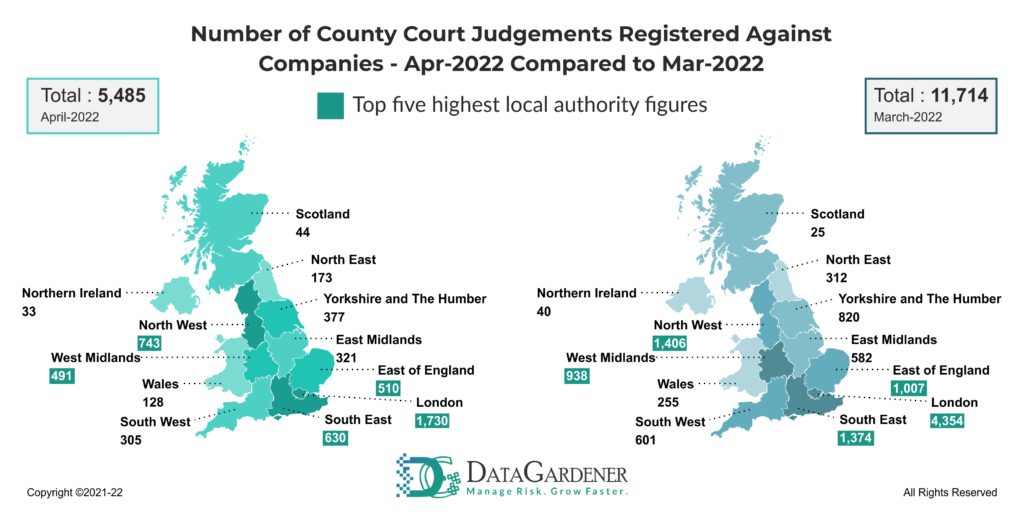

We also saw a reduced number of 5,485 CCJs filed:

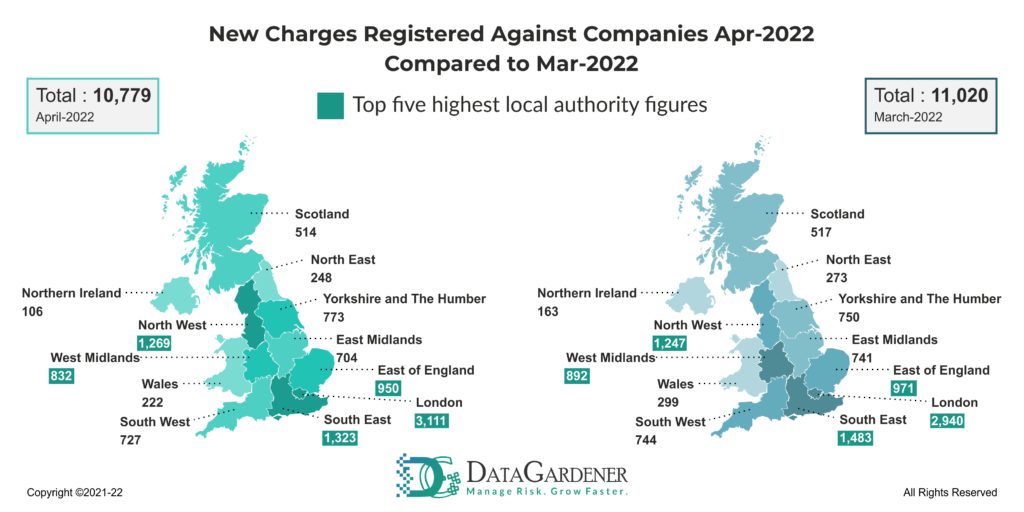

And 10,779 charges were registered:

The number of companies that have been struck off Companies House over April has increased considerably, seeing 65,018 dissolved companies! This is an increase of 19.5% from March (54,397)!

These numbers may be partly due to the continuing instability surrounding the geopolitical situation in Europe or down to recent warnings from financial experts that a UK recession may be just around the corner.

FinTech and Finance News

In trends following last month, the UK fintech sector has continued to see improved visibility both for investors and the public at large. Additionally, we have seen major changes and trends take hold of the industry, involving fintech and banking giants such as Klarna, Pillar and Natwest.

The UK leader in the ‘buy now pay later’ (BNPL) industry, Klarna, recently announced they would be disclosing customer purchases and repayments to the credit companies Experian and TransUnion from next month onwards. Ideally, this is to allow customers to build their credit score – a metric used heavily in taking out loans and mortgages – without having to take out a credit card. However, the sector has previously come under fire for not performing substantial affordability checks on customers as well as opaque product and credit agreements.

Pillar, the fintech start-up led by former Revolut executive Ashutosh Bhatt, recently raised more than £13 million in investments. The company is focused on providing access to credit for recent immigrants by leveraging open banking and data analytics to offer credit opportunities for immigrants in their new country. This new type of ‘ethical banking’ has become increasingly popular with both entrepreneurs and investors, as it is being seen as a way forward for the mainstream popularisation of ethical capitalism.

This has also been seen in recent popularised movements such as ‘Fintech Without Frontiers’, an industry-lead initiative in the UK to attempt to connect Ukrainian refugees to well-suited career opportunities. Millions of valuable and talented workers have been displaced from the country since the beginning of the war, meaning that providing these opportunities for refugees to build new and successful careers in the UK is set to benefit everyone involved. Fintech Without Frontiers is currently jointly led by members of the fintech industry, including Ozone API, Moneyhub, RegAlytics, Allica Bank, Monese, Acin, Muse Finance, Ordo, Bloom Money, The Payments Association, Open Banking Excellence (OBE) and Innovate Finance.

The Rising Importance of ESG

In trends adjacent to ethical capitalism, eco capitalism has also seen huge increases in investors and businesses over the past few years. This is exemplified in the increased number of people holding investments in sustainable investment funds and portfolios, often termed as Environmental, Social and Governance (ESG) funds.

Almost 58% of Which? members reported holding investments in such funds, but performances of these investments have so far been disappointing. ETFs such as INRG – an exchange-traded fund listed on the London stock exchange – have performed particularly poorly over the past five years, with share prices recently falling below £8.18 per share. This is down from around £14 per share a year or two prior. Additionally, many are worried about just how ‘sustainable’ these funds are since there is currently no regulation on how ‘green’ a fund has to be in order to qualify as an ESG. For example, Vanguard’s ESG Developed World All Cap Equity Index Fund (UK) includes investments in McDonald’s, Mondelez and Nestle. All of these companies have been in the news for being anti-eco, meaning their presence in a so-called ‘ESG’ is questionable at best. This so-called ‘greenwashing’ of investments has been globally frowned upon, and some have called for the government to step in and regulate what can and cannot be called an ESG.

Since the UK government has recently made it clear it wants to do as much as possible to promote sustainability, it would not be surprising to see them cave to the pressure and begin regulating these green markets. Recent sustainability moves by the government have only made this more likely – especially with the recent announcement that pupils will be able to take Natural History GCSEs from 2025 and the likelihood of them following China in introducing a sovereign-sustainability bond for investors to invest in.

Despite banks and investors looking toward new, exciting opportunities in ESGs and fintech sectors, many people in the UK are simply struggling to pay regular household and grocery bills. The Bank of England has warned of a sharp economic downturn this year, with interest rates rising to 1% this year – their highest level since 2009. Coupled with the huge increases in energy, housing, and basic groceries means that households are significantly reducing spending, stunting economic growth. Increases in mortgage rates will hit people even further, causing a projected recession later this year. This projection has, in turn, caused markets to hit huge dips. It is likely that energy bills will also push inflation up to 10.2% in the fourth quarter of 2022, a dreaded double-digit for the UK economy.

What’s happening at DataGardener?

At DataGardener, we focus on providing the information you need to make smart financial choices for your business. That is why we are excited to announce that over the next few weeks, we will be releasing a new system to simplify sustainability metrics for companies across the UK. Our ESG System helps you evaluate your company’s sustainability using ESG (Environmental, Social and Governance) indicators for measurement. Using this tool, you can track and make sure your organisation is moving in the right direction and see exactly where it needs to improve.

To save a PDF version of this report, please click on download.