In this free insights report, you will find out more about what is happening in the UK, trends and events affecting the UK’s economy, fast-growing businesses, and more.

Key Events of the Month

2022 has seen a mixed start for many, especially with the ongoing international crisis fuelling fears of global supply chain disruption. Out of the frying pan and into the fire – the humanitarian and economic cost of the invasion of Ukraine will undoubtedly be felt within the UK economy, possibly just as severely as the COVID pandemic, meaning many businesses are preparing for shortages across the board.

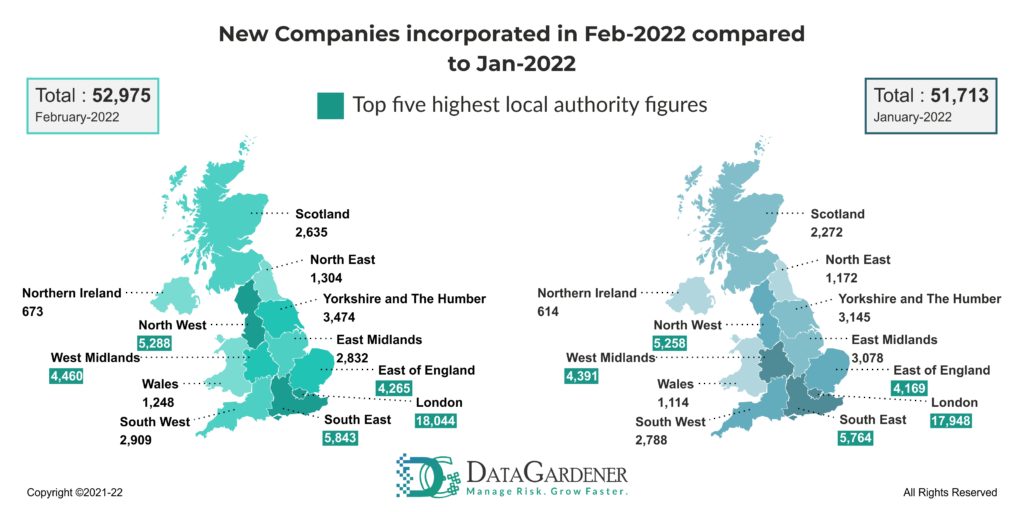

However, in light of the unrest, entrepreneurs remain undeterred, with a healthy 52,975 companies registered in February and 51,713 registered in January, though we can expect this to fluctuate within the coming months.

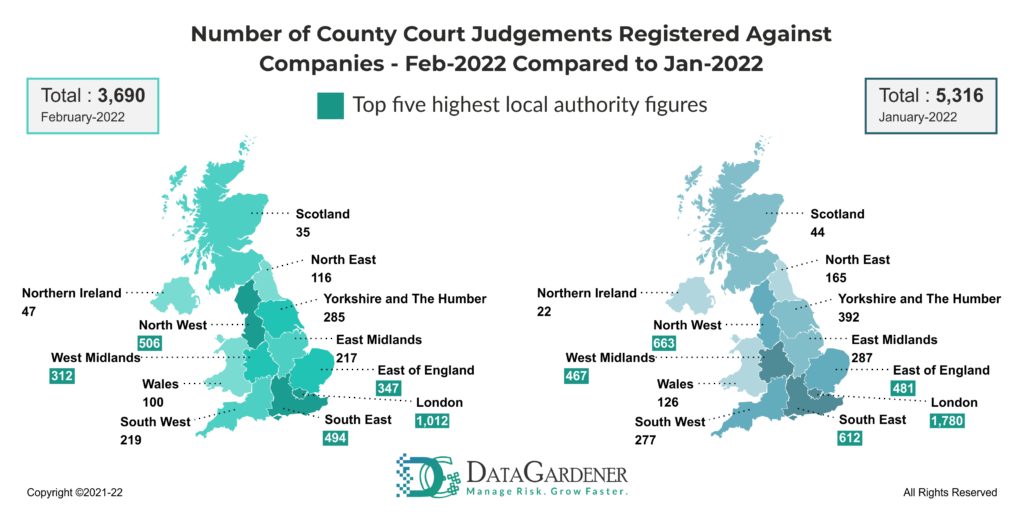

Likewise, CCJs filed are at an all time low, with only 3,690 filed in February and 5,316 in January. Again, with the projected global supply chain disruption, we can expect these to increase over the coming months.

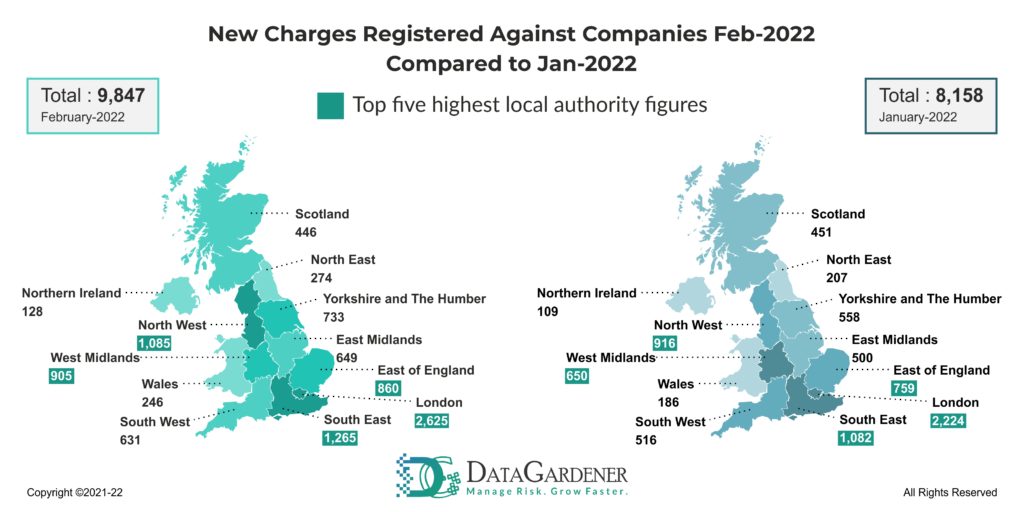

Charges registered were also slightly lower for these months, with 9,847 in February and 8,158 in January.

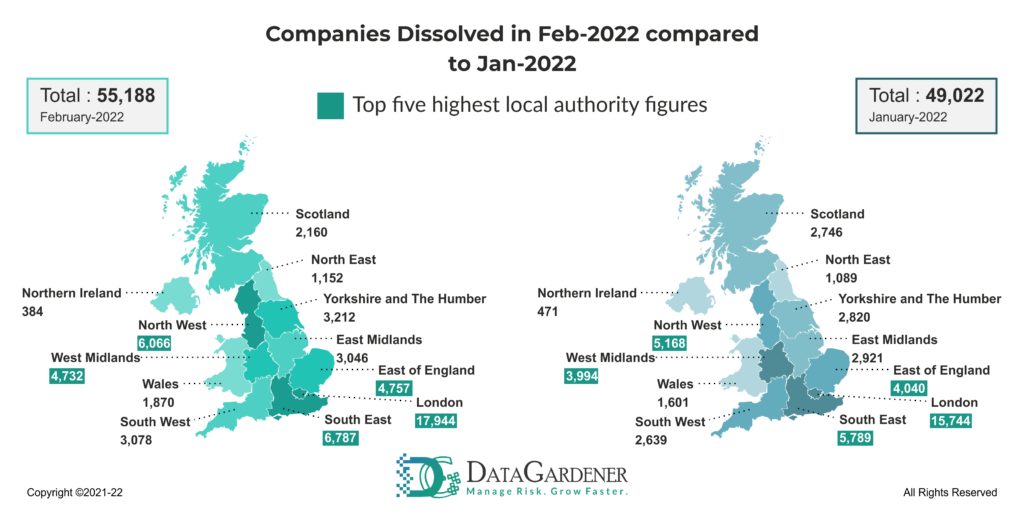

In addition to this, companies dissolved were also far lower than usual, with 55,188 in February and 49,022 in January.

2022 – An eventful year so far…

First, let’s dive into the elephant in the room. In February of this year, Russia launched a full-scale invasion of its neighbouring country Ukraine. Without even beginning to go into the huge moral and humanitarian toll this will take, the economic cost of this war is bound to be immeasurable. Between them, Ukraine and Russia are the world’s largest suppliers of grain and petroleum. With a conflict between the two, a shortage of both is incredibly likely, and this has already been reflected in stock markets, with oil pitching above $100 per barrel at the beginning of March.

Many may be quick to point out that the UK actually doesn’t import most of its oil and gas from Russia and are actually surprisingly independent of the Russian pipelines. However, though this may be correct, the UK is sure to feel the knock-on effect from countries where this isn’t the case, such as Germany and other European countries. This is already happening, with energy prices once again in the news for soaring to record levels due to disruptions in the international market. Since countries can no longer easily get Russian gas, the product produced in other countries has skyrocketed due to an artificial inflation of demand with not enough supply.

The national trade body Energy UK has predicted that energy prices may rise to as much as a 50% increase by spring, with further increases likely if the war and sanctions continue.

A second growing worry is the rumours of an incoming global famine, where the supply of wheat and grains cannot meet the growing demand of an ever-increasing global population. Although this reduction will be unlikely to significantly affect wealthy nations such as the UK, many countries not so lucky will be put in danger. Once again, it is more likely that the UK will be feeling the indirect effects of this rather than a direct famine, but it will still be more than enough to put a big dent in the UK economy.

Despite these risks, the continuation of the global sanctions on Russia is admirable considering the obvious economic detriment this will have on countries in the immediate term. Although, it may be important to remember to leave sanctions to governments rather than businesses. For example, the US counties of Ohio, Utah and New Hampshire required all liquor sellers to remove Russian made or Russian-branded products from their shelves in an attempt to hit Russian vodka exports. This attempt at economic backlash is misguided since less than 1% of US vodka is actually made in Russia, with the only household-name vodka brand made in Russia being Russian Standard.

The case is similar in the UK. It’s important to remember that although economic sanctions such as removing Russian banks from SWIFT will cripple the Russian economy, targeting Russian-branded products is usually ill-advised, ineffectual and borderline promoting xenophobia.

What’s happening at DataGardener?

In other news, we at DataGardener are proud to have been awarded the prestigious honour of being named the number one Financial Data and Business Information provider in the UK for 2022. Our team have worked tirelessly to provide the best service and product possible in this sector, and we will only be going from strength to strength in the coming year. In addition to this, we were recently chosen to take part in NatWest’s Accelerator Program for up-and-coming entrepreneurs in order to further improve our quality service.

In February of this year, we also teamed up with Grantify to produce an on-demand webinar featuring our co-founder and Director Robert Holland. This experience goes through some of the ways to maximise your business data and analytics, including how to use this data to define your target market, competitors, and produce a Go-to-Market strategy. By stressing the importance of reliable and quality data, you’re free to make informed and data-driven decisions to propel your business into success in 2022.

Conclusion

Although the facts and figures say that January and February were largely successful starts to 2022, it’s important to remain vigilant. It’s not exactly clear what effect the international disruption will have on goods and services in the UK, meaning that companies must remain adaptable. Regardless, there may be a rough few months ahead for the UK economy.

To save a PDF version of this report, please click on download.

Other Articles: