Once again, inflation and political instability were at the forefront in June, in a trend that is destined to last throughout the rest of the year. According to Eurostat, the official statistical branch of the European Commission, inflation hit highs of 8.6% this year, with these rates expected to continue well into the year 2023. Although inflation does not necessarily signal an economic downturn, it will certainly impact markets by increasing the volatility of raw goods prices for a while. Read further for July 2022 UK insights.

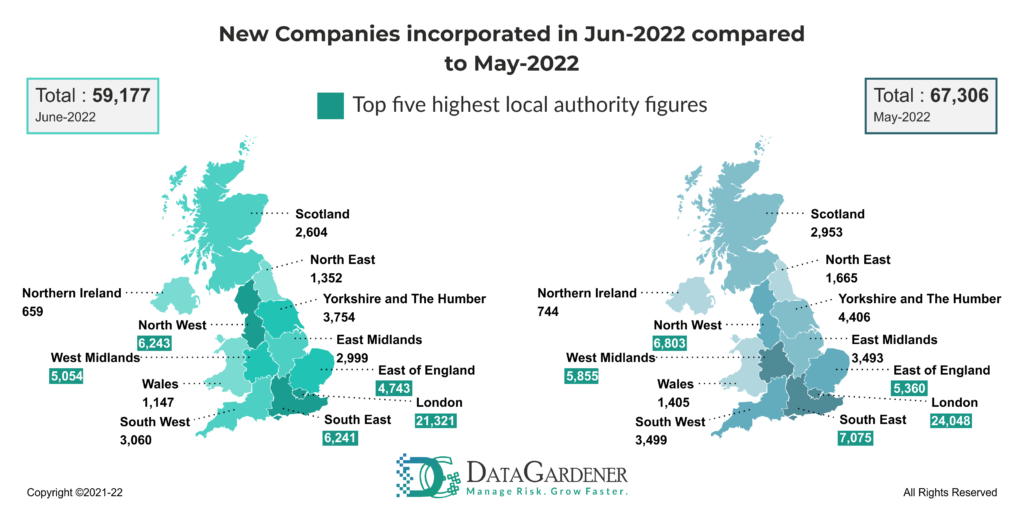

Despite this, business owners remain undeterred in the UK, with 59,177 companies registered throughout June.

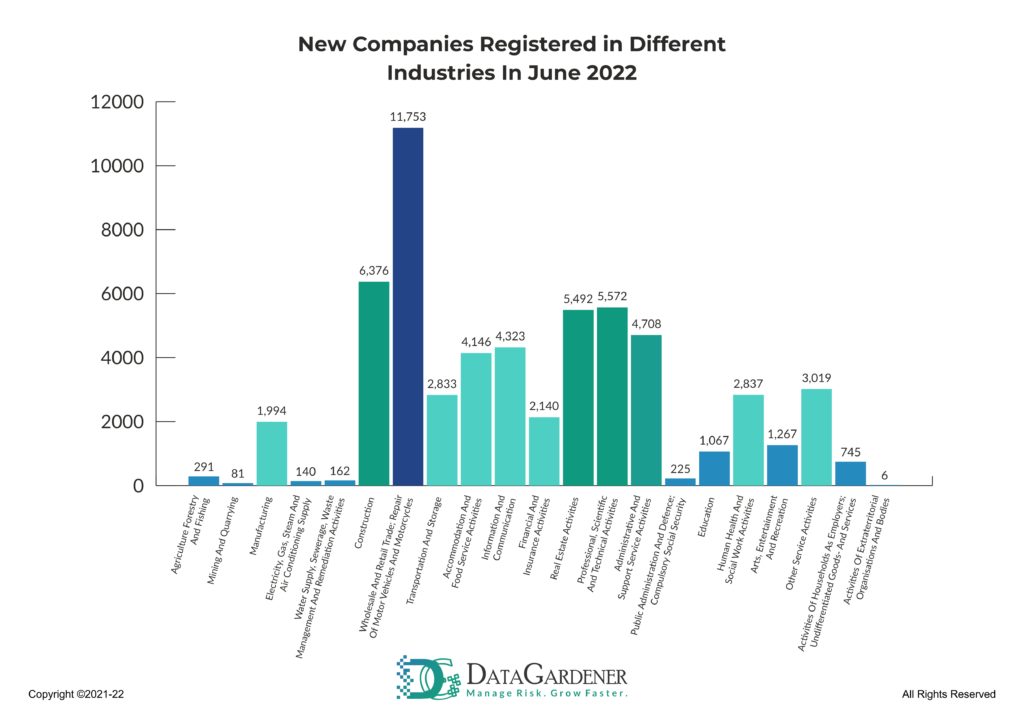

Surprisingly, the Accommodation and Food Services Activities sector comprised one of the largest growing sectors this month, with 4,146 formed companies.

With the significant volatility in raw goods markets, it seems somewhat surprising to see so many entrepreneurs enter the space when wholesale prices for cattle, grains and oils are at an all-time high. Since the volatility of grain prices, in particular, has been so heavily tied to the war in Ukraine, it also seems unlikely that these costs will fall soon.

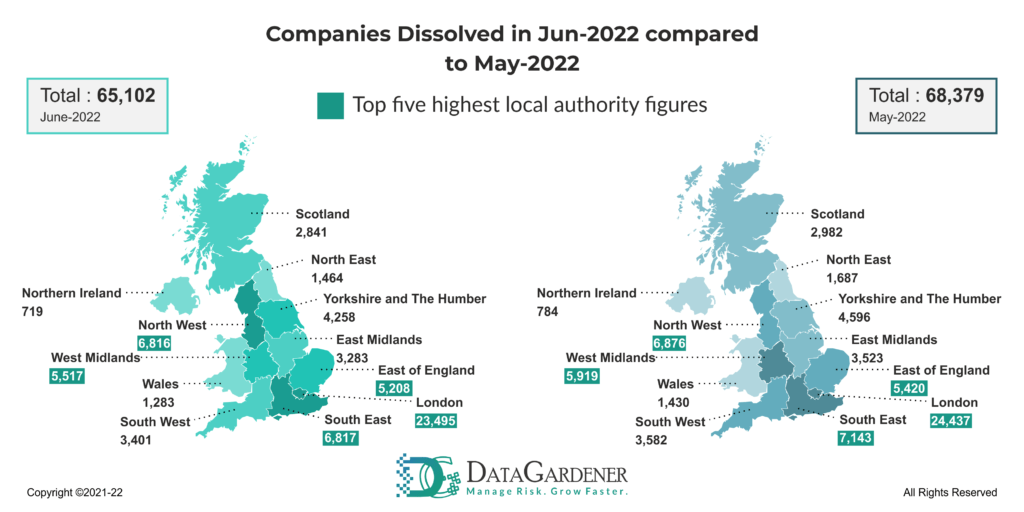

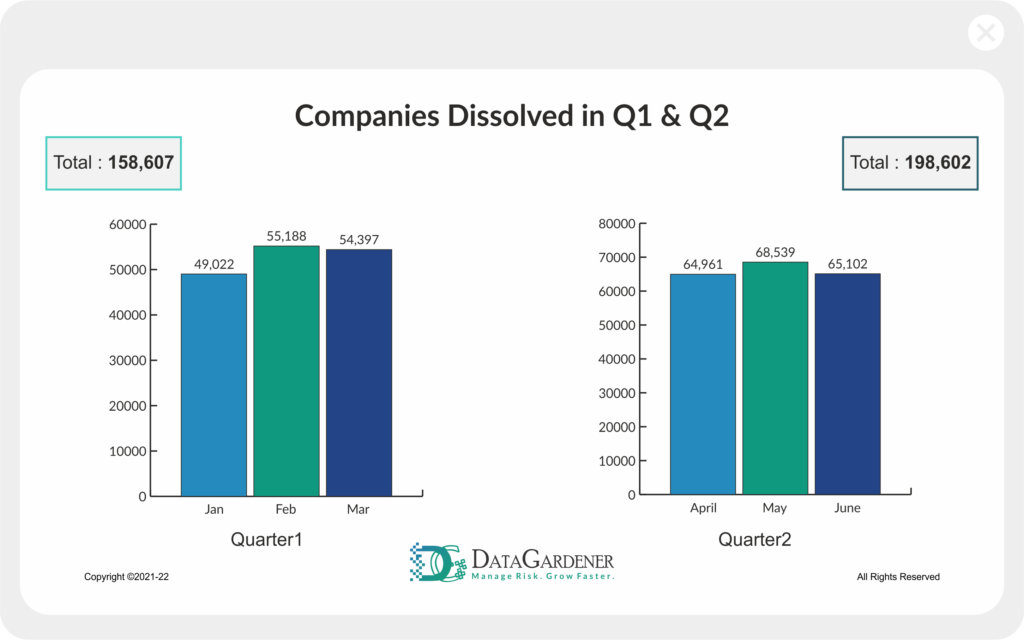

The number of companies dissolved throughout June has also remained quite high and similar to previous months, with almost as many companies being dissolved as being created – around 65,102.

This is expected, especially as inflation and geopolitical instability still seem to be heading out of control.

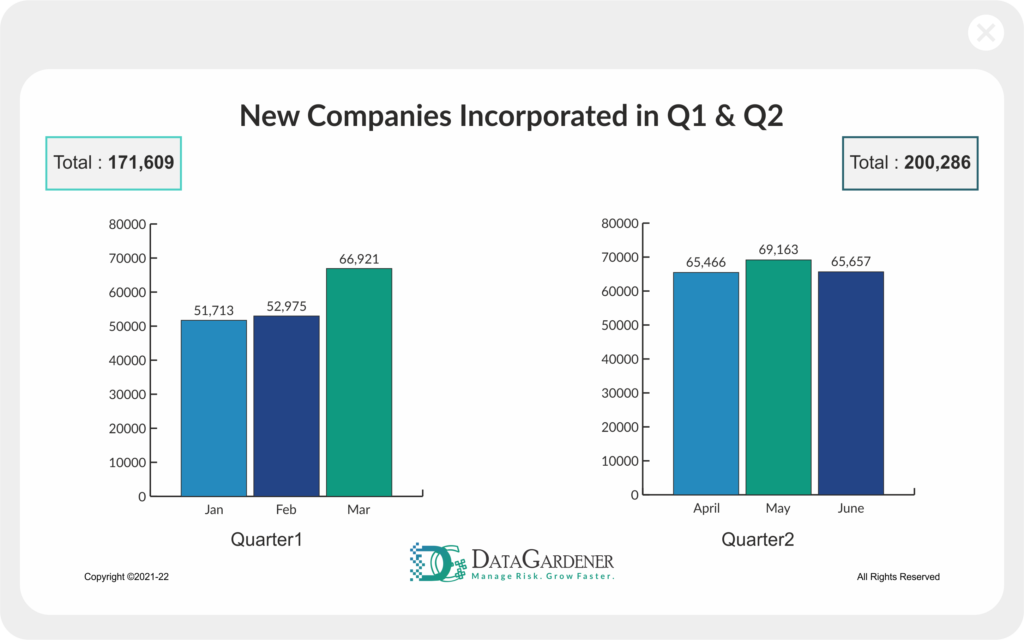

What’s different in Q2 from Q1?

For the most part, Q2 of 2022 has by far made up for the slow start to the year seen in Q1. Only around 171,609 companies were formed in Q1, whilst a much larger 200,286 companies were formed in Q2 of this year.

This seems counter-intuitive, especially since the cost-of-living crisis, the war in Ukraine and the rise in inflation all started around March – the tail end of Q1. Perhaps investors and entrepreneurs were attempting to take advantage of the less-than-ideal economic situation, with niches in new markets opening up everywhere due to the increased volatility. However, this risky tactic seems to have not taken off all that well.

Especially since Q2 also saw a much larger number of companies being dissolved than Q1. 198,602 companies were disbanded in Q2, almost as many as created simultaneously. In contrast, Q1 only saw 158,607 companies dissolved – proportionally and numerically much less than Q2. Other figures between the two quarters are quite unremarkable.

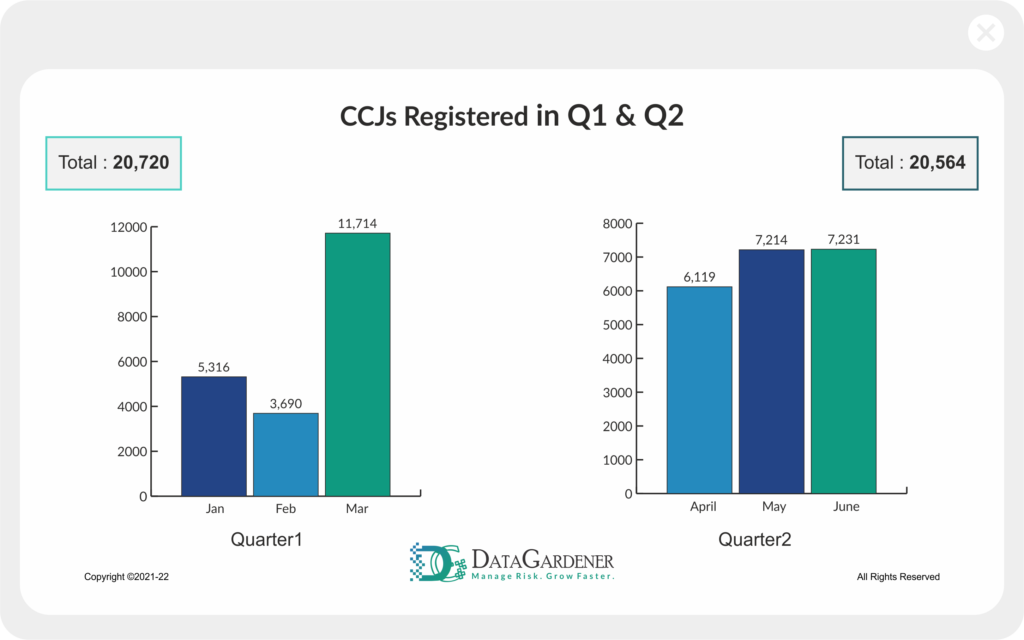

CCJs filed were almost identical between Q1 and Q2, with 20,720 and 20,564, respectively – July 2022 UK insights

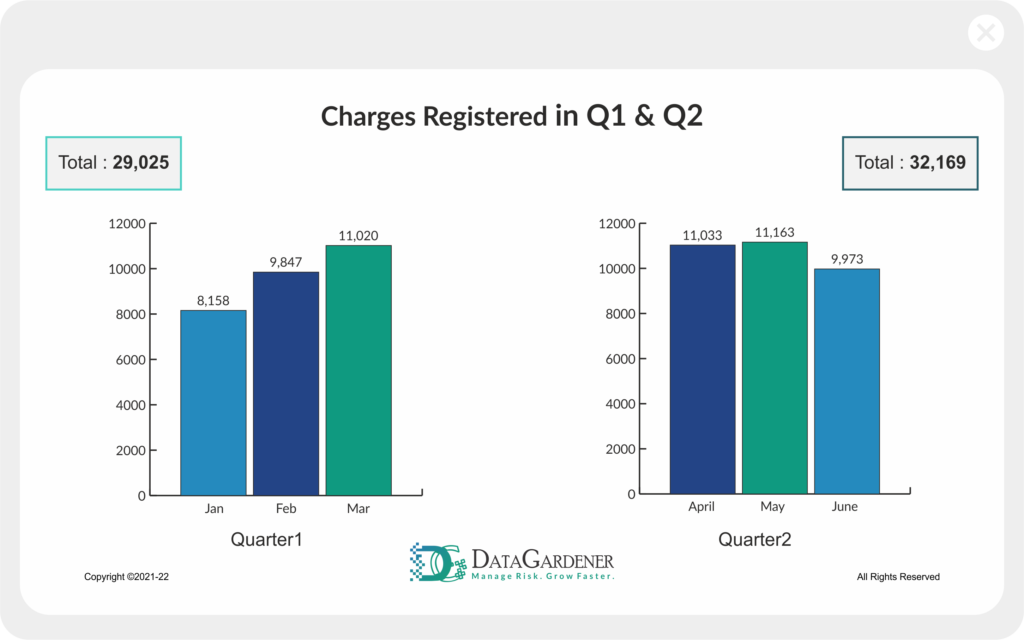

Charges registered were also reasonably similar, with 29,025 in Q1 and 32,169 in Q2 – July 2022 UK insights

What’s in the News? – July 2022 UK insights

The Fintech World – July 2022 UK insights

This month, more good news for the UK fintech scene as the Deputy Mayor for Business hails the capital as the ‘fintech capital of the world’. London hosts more than 3,000 fintech companies alone, with $6.3 billion raised in investment during the first 6 months of 2022. Compared to other European cities such as Berlin and Paris, London has more than tripled the total value in its tech market. Simultaneously, the Deputy Mayor called for the country to remain open to stimulate this fast growth further, calling on the UK to loosen immigration policy to fill the skills shortages currently being experienced by the sector. There are currently 150,000 tech vacancies in the UK – making it one of the most understaffed sectors in the country.

In similar news, London-based fintech Currensea recently raised £1.35 million on the crowdfunding platform Seedrs. This start-up is dedicated to helping customers save money whilst travelling, reducing the fees and charges levied by high-street banks. Another fintech start-up named Zeed, which raised £205,000 this month, focuses on using ‘tik-tok style’ videos to break down the investment and financial worlds for the Gen Z market. Salam Hussain, the CEO of Zeed, says his company aims to increase Gen Z’s confidence in their economic and investing knowledge.

The ESG Movement – July 2022 UK insights

Critics of the ESG movement came out this month, accusing London of falling well behind its European counterparts despite many so-called ESG companies. The teenage face of climate action, Greta Thunberg, previously criticized the city for playing catch-up on the green ESG front. Additionally, New Financial has estimated that London is around 4-5 years behind other European countries regarding green finance. This has led stakeholders in many major UK-based companies to put large amounts of pressure on businesses regarding environmental impact. This is partly due to asset managers’ pressure to rebalance portfolios to include substantial numbers of green, carbon-neutral companies. This increase in pressure has also forced some to take action against companies and directors that perpetuate climate transgressions. The volume of these cases has increased in recent years, seemingly alongside the UK court’s decision to entertain the prosecution for these cases.

Economic Rundown – July 2022 UK insights

Finally, no economic rundown can be written about June 2022 without mentioning the continually rising costs of goods and services in the UK. Although the UK economy grew by 0.5% this month, fuel and groceries prices continue to rise for households across the country as disposable incomes fall further. Many worry that this signals the beginning of a recession for the country, and the current political instability with the resignation of Boris Johnson doesn’t seem to be helping matters.

There are also worries that the continual rise in salaries for London finance and fintech workers is only deepening this inequality. Whilst many workers are facing real cuts to wages due to inflation, finance professionals’ salaries seem to be growing more than ever.

DataGardener News

With great pride and excitement, we announce that DataGardener has been listed in the AIFintech100 2022 companies. This organization is dedicated to recognizing FinTech companies using AI to transform financial services. To be recognized as one of the world’s most innovative fintech companies using AI is an excellent achievement for us, and we’re looking forward to pushing the boundaries even further into the future.

To download a PDF version of this report, please click on Download.