Whether you’re preparing for a new business partnership, conducting due diligence, or simply exploring new opportunities, performing a Company Turnover Check can provide valuable insights into a company’s financial health and overall performance. Turnover, also referred to as revenue or sales, represents the total value of goods or services sold within a specified period. It’s often the first figure people use when assessing business size or growth potential.

In this guide, we’ll explain how to perform a Company Turnover Check for UK businesses, both the traditional, time-consuming way through Companies House, and the smarter, faster alternative using DataGardener.

How to Check Company Turnover with Companies House

Companies House is the official register of UK businesses and is often the starting point for finding financial data, such as turnover. However, while the data is free and public, navigating it can be tedious and complex.

Here’s what the manual process typically looks like:

- Search for the company, but be cautious, as this can be a tricky task. For example, searching for “Barclays PLC” yields over 100 similarly named entries, and it’s not always clear which one is the correct one.

- Browse the filing history — even once on the correct profile, you’ll have to scroll through many filings to find the proper accounts document.

- Download the PDF — these are often scanned paper copies, making them unsearchable and hard to read.

- Find the financials — the turnover figure may be labelled as “Revenue” or “Sales” and buried deep in the profit and loss section.

If you need to check multiple companies or view changes in turnover over time, you’ll need to repeat the process numerous times. It’s time-consuming and unsustainable, especially if you’re working at scale.

How can you check a company’s turnover online?

This is simple. If a company is filing Full Accounts, you can easily see the company’s turnover. The size of your company will determine whether you must submit full or filleted accounts. For example:

- Micro-entity accounts – To file accounts, it is a must to meet at least 2 of the following criteria:

- The average number of employees is not more than 10

- The total of the balance sheet is not more than £316,000

- The company’s turnover is not more than £632,000

- Abridged accounts – To file accounts, it is a must to meet at least 2 of the following criteria:

- The average number of employees is not more than 50

- The total of the balance sheet is not more than £5.1 million

- The company’s turnover is not more than £10.2 million

- Full accounts with HMRC and Companies House – Joint accounts are ideal for small-sized companies that must file full accounts with HMRC and Companies House and are audit-exempt. It is possible to file the tax returns at the same time with HMRC.

- Dormant company accounts – These accounts are limited by shares for companies or by an assurance that they have never traded or filed using the Web Filing service.

Filleted accounts do not reveal turnover, margins, or profits. Therefore, businesses often choose this option. However, companies must still prepare full accounts for their shareholders and HMRC to support their company tax returns.

Want insights like this in your inbox?

Subscribe to our newsletter for updates and industry trends.

Deadline for filing accounts

Each business will have an accounting reference date. The deadline for filing your accounts is calculated based on this date. It will be the anniversary of the day after the previous financial year ended for existing businesses. The time limit for delivering accounts is nine months from the accounting reference date.

Companies House may impose penalties if you fail to file your company accounts on time. These penalties can range from £150 for filing less than a month late to £1,500 for filing more than six months past the deadline. Failure to file confirmation statements, annual returns, or accounts is a criminal offence, and directors or LLP appointed members may face criminal charges. Failing to pay your late filing penalty can result in enforcement and criminal proceedings.

How to Check Company Turnover with DataGardener

At DataGardener, we make financial intelligence straightforward. Our powerful business intelligence platform provides comprehensive, accurate, and instantly accessible turnover data on all UK companies, eliminating the need to navigate PDFs or decipher accounting jargon.

With a database of over 16 million UK businesses, sourced and verified from Companies House, HMRC, Land Registry, and other reputable sources, you get more up-to-date access to:

- Company turnover (last 4 years)

- Business activity, director data, and ownership structure

- Credit reports and risk scores

- Trading addresses vs registered offices

- Charges and financial liabilities

- Key decision-makers and contact information

- Property ownership and land intelligence

- Funding, growth stage, and more

1. View Turnover Directly from Company Profiles

No more digging through PDFs. Simply search for the company name and open its DataGardener profile. You’ll find:

- Turnover, assets, liabilities, and profit/loss

- Changes over time, with 4-year historical views

- A clear, standardised format across every company

- Credit risk data to help you assess stability

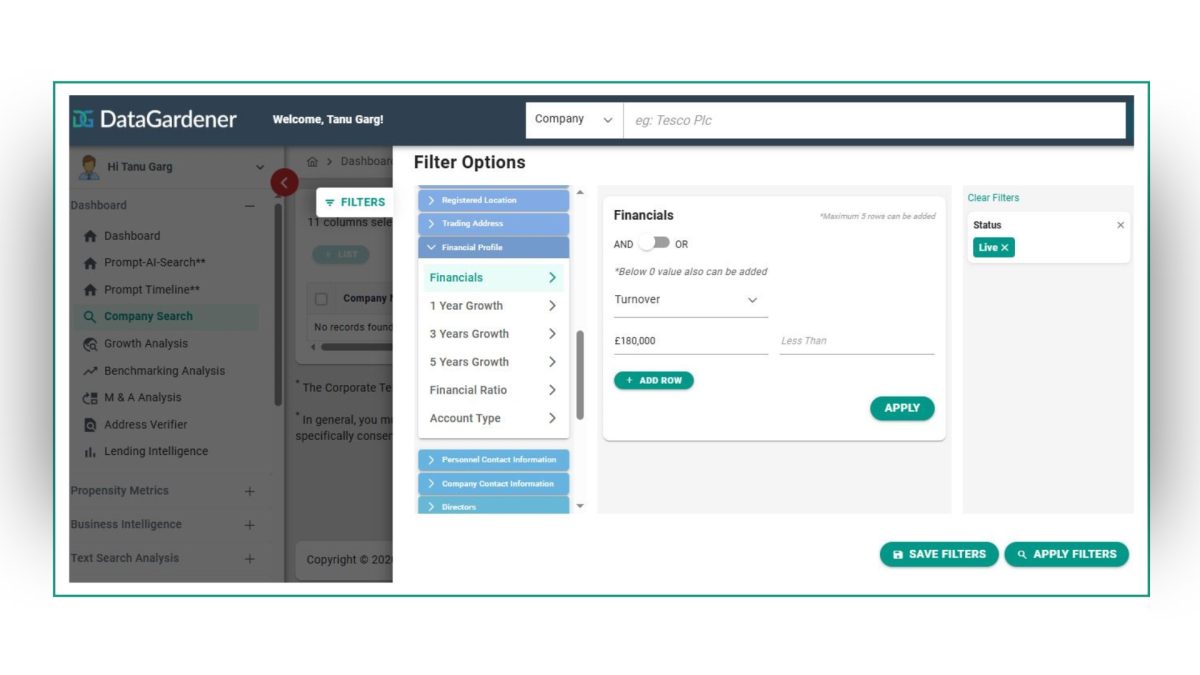

2. Search for Companies by Turnover or Any Other Financial Metric

Unlike Companies House, where you need to know the company name in advance, DataGardener’s advanced filters let you search for businesses that match your exact criteria:

- Location (by postcode, city, or region)

- Turnover thresholds (e.g., SMEs under £10M, or companies with £50M+ revenue)

- SIC code or business activity (e.g., fintech, logistics, AI)

- Director gender, employee count, or ownership structure

- Fundraising history, charge data, or credit rating

Want fintech companies in Manchester with £10M+ turnover and a female director? Easy. Just set the filters and go.

3. Compare Companies by Turnover at a Glance

Once you’ve built a list, simply sort and compare companies by turnover or any other relevant metric, such as profit margin, EBITDA, employee count, or fundraising total.

Great for:

- Competitive analysis

- Market mapping

- Identifying acquisition targets or partners

- Tracking growth within industries or regions

Three More Ways to Find Business Information with DataGardener

DataGardener isn’t just about checking a company’s turnover; it’s about seeing the bigger picture.

Whether you’re a policy maker, researcher, lender, or strategic decision-maker, these three capabilities empower you to dig deeper and make smarter business decisions.

1. Understand Regional Business Ecosystems

DataGardener’s powerful Location Intelligence feature lets you explore how businesses operate across the UK, from the national level right down to a specific postcode.

With it, you can:

- Analyse regional business density and company formations

- Discover growth hotspots and sector clusters by location

- Track incorporation trends and business age distributions

- Filter companies by director demographics, credit risk, size, or SIC code

This is particularly useful for councils, local enterprise partnerships (LEPs), and regional economic teams working to boost local economies or deliver tailored support.

2. Set Up Alerts to Monitor Company Changes in Real-Time

Company data is constantly evolving — and staying informed at the right time is key. With DataGardener, you can create intelligent latest-time alerts that notify you the moment something significant changes.

Here’s what you can monitor:

- Turnover and financial filings

- Director changes or appointments

- Status updates (dissolved, active, dormant)

- New charges, CCJs, or signs of financial stress

- Change of registered office, shareholders, or company structure

Add specific companies or entire lists to your Watchlist, and let DataGardener do the monitoring for you.

This feature is essential for lenders, brokers, procurement teams, and investors looking to stay ahead of risk and act on new opportunities quickly.

3. Understand Industry Business Ecosystems

With access to detailed industry-level data through SIC code segmentation, DataGardener helps you understand how different sectors are performing — and where opportunities lie.

You can:

- Benchmark turnover, net worth, or growth across sectors

- Assess competition levels and identify saturated or underserved industries.

- Explore industry maturity by company age, size, and filing behaviour.

- Uncover emerging trends and shifts in key markets.

This level of insight enables strategy teams, market researchers, and analysts to make informed decisions regarding investment, diversification, and market entry.

Final Thoughts

DataGardener is your go-to platform for reliable UK business intelligence. Whether you’re verifying a company’s turnover for due diligence, assessing financial health, or identifying growth opportunities in your target market, DataGardener makes it easy. Go beyond just turnover, explore detailed company profiles, director information, financials, credit scores, funding data, and more. With access to over 16 million UK companies and powerful filtering tools, DataGardener enables you to make smarter business decisions more quickly.

This article is a guide to help you understand the process of running a Company Turnover Check and its meaning. If you have any questions or wish to learn more about how we can help you, please connect with us at +44 333 444 0685 or get in touch with one of our experts at support@datagardener.com.

Think Data. Think DataGardener

DataGardener users double their leads and cut research time in half — with smarter data, faster insights, and better decisions.

Related articles:

- All About Company Formation UK With Registered Office

- What is a Company Registration Number?

- How a structured B2B Contact database can help drive sales

- Everything you want to know about Statutory Accounts